AI Packaging Arms Race: Amkor's $7B Bet, Intel's NVIDIA Win, and Cadence Riding the Wave

Welcome, AI & Semiconductor Investors,

Amkor Technology supercharged its bet on U.S. soil with a massive $7 billion investment in Arizona, aiming squarely at an AI-driven advanced packaging boom. Meanwhile, Intel, bolstered by strategic cash infusions, including a notable $5 billion partnership with NVIDIA, faces capacity constraints despite soaring AI chip demand. Cadence Design Systems, riding the AI infrastructure surge, hits a record $7 billion backlog, positioning itself as the critical backbone for the industry’s AI ambitions. — Let’s Chip In.

What The Chip Happened?

🏭 Amkor Goes All-In on Arizona—Bets Big on AI Packaging Boom

🤖 Cadence Hits Record Backlog as AI Wave Boosts Outlook

🟢 Intel’s AI Revival: Capacity Crunch and Strategic Wins

[Intel Q3’25: Margins Rebound, AI Partnerships Heat Up]

Read time: 7 minutes

NEW SEMICONDUCTOR COMMUNITY — 50% OFF FOUNDING RATE

Amkor Technology (NASDAQ: AMKR)

🏭 Amkor Goes All-In on Arizona—Bets Big on AI Packaging Boom

What The Chip: Amkor Technology just turned up the heat on its U.S. expansion plans, announcing on its Q3 earnings call (October 27, 2025) an increased Arizona investment of $7 billion, highlighting a dramatic uptick in demand for domestic semiconductor packaging and testing, especially driven by AI and advanced computing.

Details:

🏗️ Mega Expansion in Arizona: Amkor is significantly ramping up its Arizona campus investment to $7 billion, featuring 750,000 square feet of cleanroom space and promising up to 3,000 jobs. Phase 1 is targeted for completion in mid-2027, with production starting early 2028. CEO Giel Rutten emphasized surging U.S. manufacturing interest and customer commitments as key drivers.

📈 Margin Boost Ahead: CFO Megan Faust outlined a strategic path to expand corporate gross margins by ~100 basis points by the end of 2027. This improvement hinges on optimizing manufacturing in Japan, efficiency gains in Vietnam, mainstream recovery, and ramping advanced packaging technologies.

⚠️ Near-Term Margin Pressure: Despite robust revenue growth, near-term gross margins face headwinds due to product mix and higher upfront costs for scaling advanced packaging technologies. Gross margins for Q4 are expected to be constrained by higher manufacturing expenses and unfavorable product mix compared to last year.

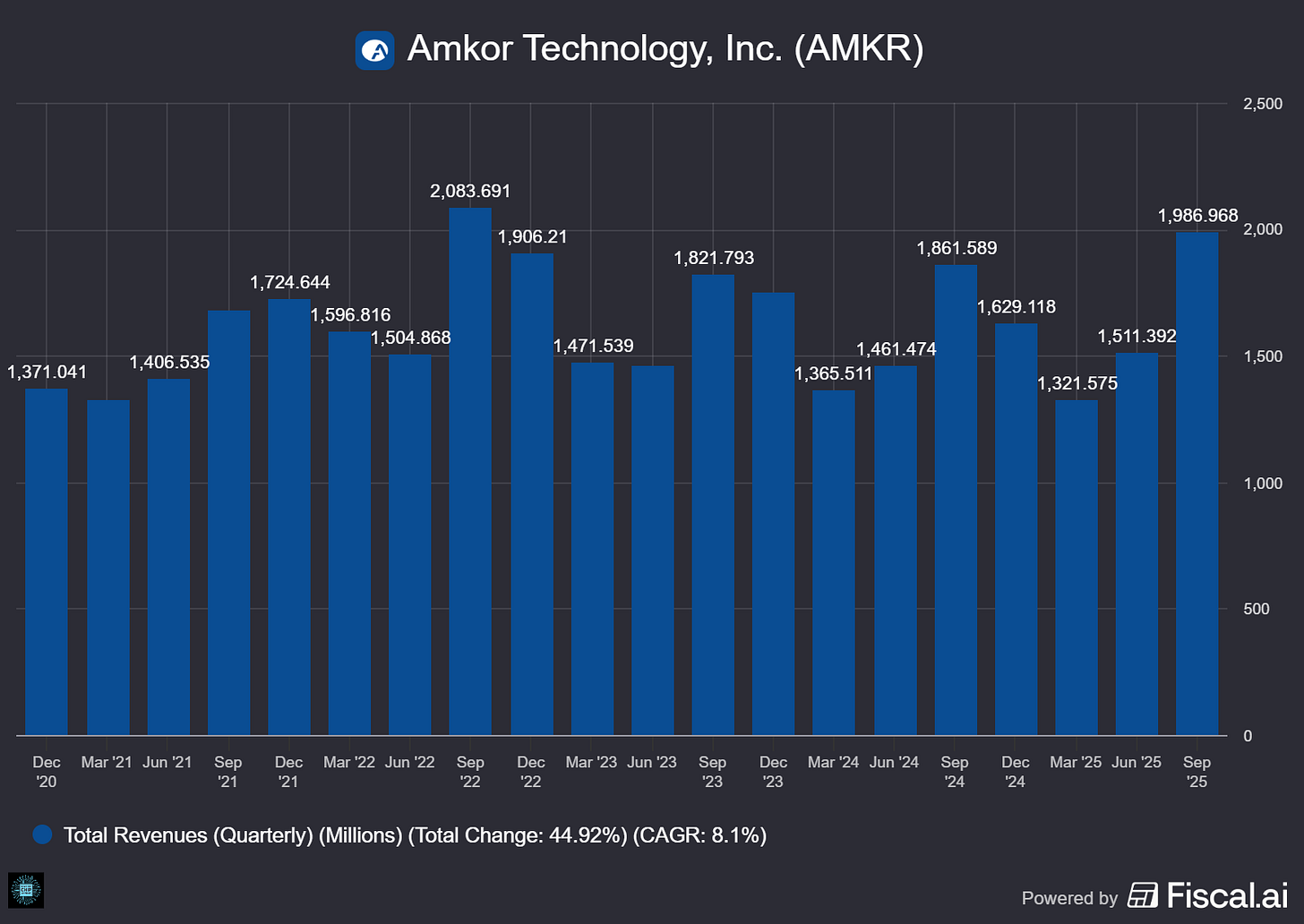

💰 Strong Financial Performance: Q3 2025 revenue hit $1.99 billion (up 31% sequentially, 7% year-over-year), surpassing guidance. EPS was $0.51, and gross margin improved to 14.3% (up 230 basis points sequentially), with advanced products revenue climbing sharply to $1.68 billion.

💼 Solid Financial Position: The company remains well-capitalized with $2.1 billion in cash and short-term investments and total liquidity of $3.2 billion. Amkor raised its 2025 CapEx guidance from $850 million to $950 million, largely for the Arizona campus.

🚧 Capacity Crunch is Real: CEO Rutten noted existing tightness in advanced packaging capacity, particularly for flip chip and wafer-level packaging technologies, underscoring ongoing constraints despite aggressive expansions.

🤖 AI Demand Surge: Rutten highlighted broad-based growth driven by accelerated AI adoption across multiple end markets, including edge devices, communications, and data centers, reinforcing the long-term secular growth trajectory for advanced packaging technologies.

🚀 High-Density Fan-Out (HDFO) Ramp: Amkor is aggressively scaling its HDFO capacity, with investments in highly flexible equipment. It’s currently ramping multiple products with major customers, signaling significant near-future revenue growth.

Why AI/Semiconductor Investors Should Care: Amkor’s substantial investment boost in Arizona signals a seismic shift toward domestic advanced packaging—a critical component for AI and semiconductor infrastructure. For NVIDIA and other AI chip giants, this campus significantly de-risks the advanced packaging supply chain. Meanwhile, capacity constraints in advanced packaging highlight a crucial bottleneck that Amkor is actively addressing, positioning it as a vital player in the AI hardware ecosystem. Investors should note both the short-term margin pressures from heavy upfront investment and the substantial long-term payoff as advanced packaging transitions from a niche necessity to a central pillar of the semiconductor industry.

NEW SEMICONDUCTOR COMMUNITY — 50% OFF FOUNDING RATE

Intel (NASDAQ: INTC)

🚀 Intel’s AI Revival: Capacity Crunch and Strategic Wins

What The Chip: Intel’s Q3 2025 earnings, announced recently, highlighted persistent supply constraints despite strong demand, a robust AI-driven growth strategy, and significant cash inflows bolstering its manufacturing capabilities.

Details:

📈 Demand Exceeding Supply: CFO David Zinsner confirmed ongoing manufacturing constraints, particularly on Intel 10 and Intel 7 nodes, limiting full demand fulfillment in Q3. These limitations are expected to continue into 2026, suggesting potential revenue upside as Intel ramps up capacity.

💡 AI’s Dual Boost: CEO Lip-Bu Tan underscored how AI is not just accelerating demand for new architectures but is also rejuvenating traditional compute markets. This dual opportunity strengthens Intel’s market position across both cutting-edge and legacy workloads.

💰 Cash Boost from Key Partnerships: Intel significantly improved its balance sheet with nearly $20 billion in new cash, including a notable $5 billion investment from NVIDIA, $5.7 billion from the U.S. government, $2 billion from SoftBank, and $5.2 billion from Altera and Mobileye asset sales, dramatically enhancing operational flexibility.

💻 Solid Segment Performance: Client Computing revenue reached $8.5 billion, boosted by new product launches like Lunar Lake and Arrow Lake. Data Center and AI revenue stood strong at $4.1 billion, reflecting increased AI demand. However, Intel Foundry continues to struggle, recording a $2.3 billion operating loss, though improved sequentially by $847 million.

⚠️ Margin Pressure Ahead: Intel faces short-term headwinds due to product launches and unfavorable cost structures. CFO Zinsner noted Lunar Lake’s initial margin dilution and ongoing competitive pressures, especially acute in the data center segment.

🔧 Foundry Execution Risk: Intel’s foundry business remains unprofitable, posting a -54.8% operating margin. Successfully competing against established foundries like TSMC and Samsung hinges on flawless execution of Intel’s upcoming 18A and 14A nodes.

🤖 AI Infrastructure Demand: Intel sees significant growth in CPU demand driven by the expanding AI infrastructure market. Executives emphasized CPUs’ critical role, forecasting a greater than 10x increase in AI capacity by 2030, indicating ample future opportunities for Intel.

🤝 NVIDIA Partnership: Intel’s strategic collaboration with NVIDIA, featuring a $5 billion investment and manufacturing NVIDIA’s custom AI chips, validates Intel’s advanced foundry capabilities. This partnership could transform Intel into a key supplier in the advanced AI chip market, diversifying NVIDIA’s manufacturing beyond TSMC.

Why AI/Semiconductor Investors Should Care:

Intel’s strategic pivot to harness AI-driven growth presents substantial opportunities but also underscores ongoing execution risks. The NVIDIA partnership, especially leveraging Intel 18A, could redefine Intel’s competitive stance in advanced chip manufacturing, offering potential revenue diversification and long-term growth in AI infrastructure. Investors should carefully monitor Intel’s execution in foundry operations and margin management, as these will critically influence the company’s turnaround trajectory.

Cadence Design Systems (NASDAQ: CDNS)

🚀 Cadence Hits Record Backlog as AI Wave Boosts Outlook

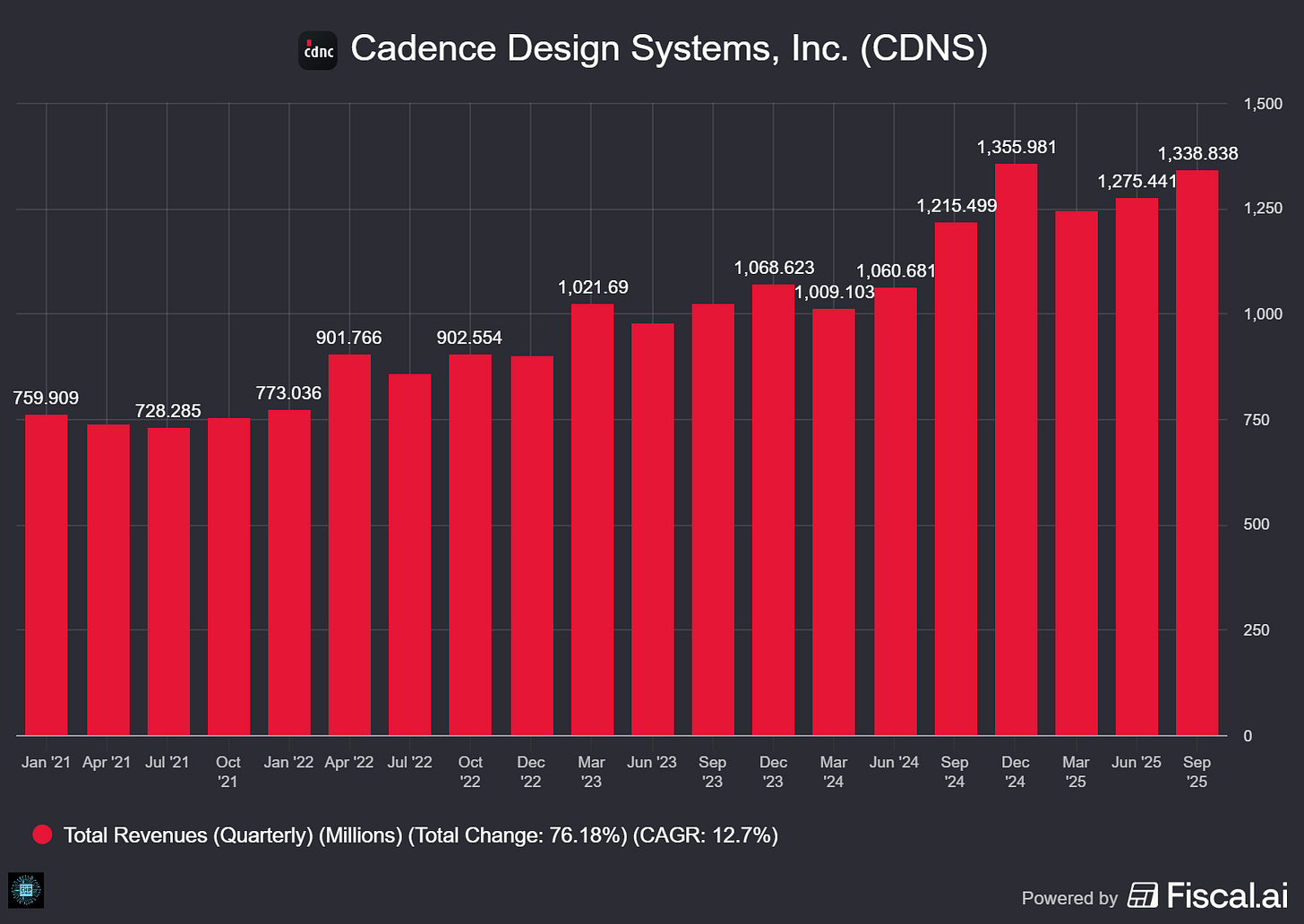

What The Chip: Cadence delivered robust Q3 2025 earnings on October 27, 2025, achieving a record backlog of $7.0 billion and raising full-year guidance, driven by accelerating AI infrastructure investments and strategic partnerships.

Details:

📈 Record Backlog: Cadence reached a new backlog high of $7.0 billion, boosted partly by a $150 million catch-up from China. CFO John Wall noted the momentum positions Cadence strongly into FY26.

🤖 AI Infrastructure Boom: CEO Anirudh Devgan emphasized accelerating AI infrastructure builds as critical drivers. Cadence is essential to AI chip designs, collaborating closely with tech giants like NVIDIA, AMD, Broadcom, and the “Mag 7.”

📊 Impressive Q3 Financials:

Revenue grew to $1.339 billion, up 10% YoY.

Non-GAAP operating margin expanded to 47.6% from 44.8%.

Non-GAAP EPS reached $1.93, a significant jump from $1.64 in Q3 2024.

Free cash flow was strong at $277 million.

🚧 Short-term Supply Challenges: Demand for Cadence’s hardware verification platforms is robust, causing near-term hardware capacity constraints. The company is actively scaling manufacturing and inventory to manage these supply chain hurdles.

⚠️ Geopolitical Risks: Ongoing compliance with export controls, especially around China, introduces short- and long-term uncertainty. Regulatory oversight remains a critical watchpoint.

💡 Custom Silicon Opportunity: AI-driven complexity and custom silicon are surging, now representing 45% of Cadence’s business. The company’s deep integration into AI-centric chip design provides significant growth opportunities.

🌐 Strategic Acquisitions: The Hexagon acquisition positions Cadence to dominate growth in physical AI, 3D-IC, and high-performance computing. Expanded partnerships, including with OpenAI, underline this strategic focus.

🟢 Nvidia Collaboration: Cadence benefits significantly from its deep partnership with Nvidia, witnessing substantial performance gains in verification workloads. Regardless of market shifts toward custom or merchant silicon, Cadence’s broad collaboration model ensures sustained growth.

🎯 AI-driven Productivity: Cadence’s dual AI strategy—Design for AI and AI for Design—delivers measurable results, with verification tools like SimAI achieving 5x to 10x efficiency improvements, validated by leading customers such as Samsung, Qualcomm, and NVIDIA.

Why AI/Semiconductor Investors Should Care: Cadence’s growing backlog, fueled by the AI chip design surge and deep collaborations across the industry, positions it uniquely to capture outsized gains from both merchant and custom silicon trends. However, investors should remain cautious about geopolitical exposure and short-term supply constraints impacting near-term performance.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

NEW SEMICONDUCTOR COMMUNITY — 50% OFF FOUNDING RATE

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] Intel Q3’25: Margins Rebound, AI Partnerships Heat Up

Event date: October 23, 2025

Executive Summary

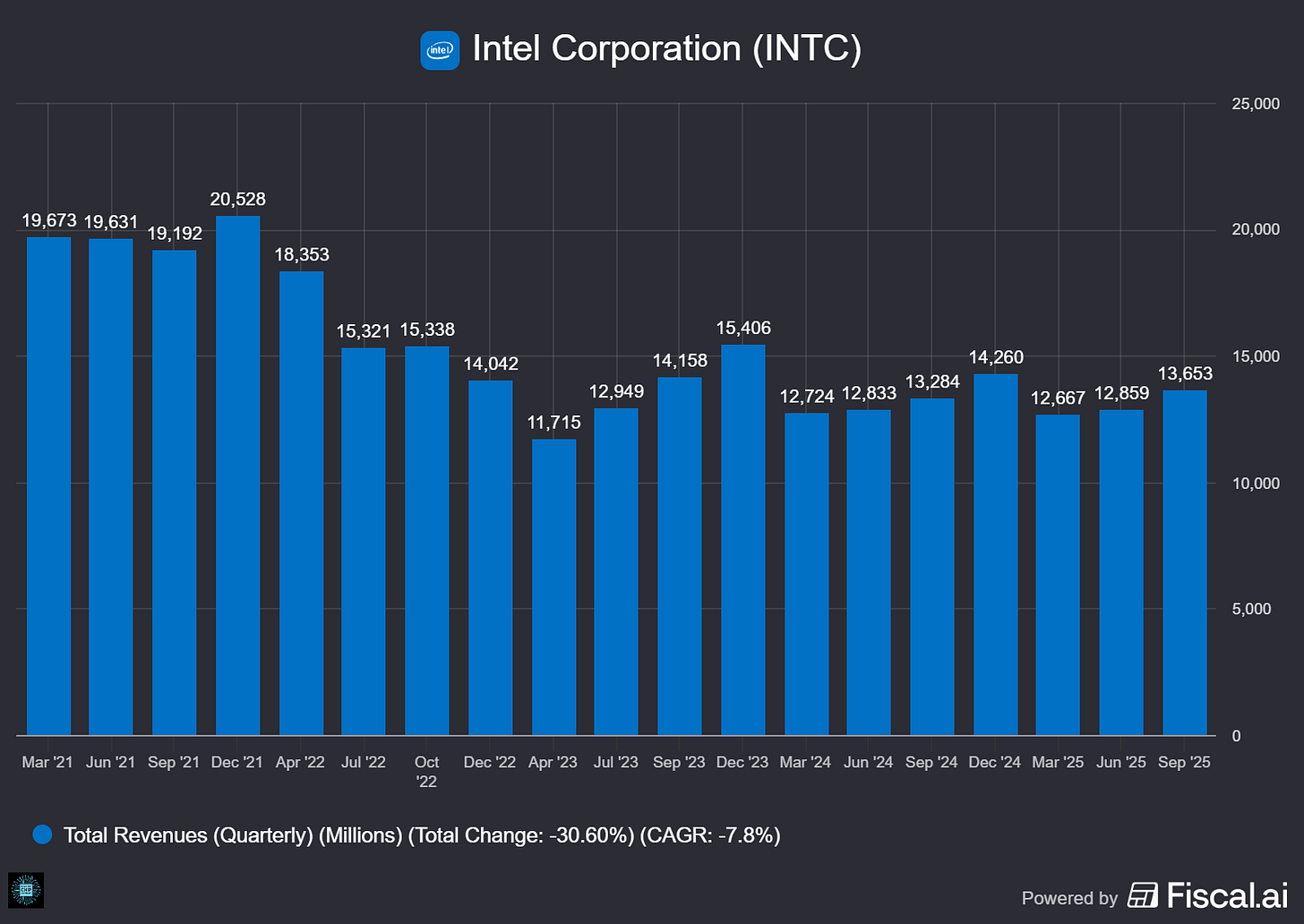

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

Intel reported third‑quarter revenue of $13.7 billion, up 3% year over year, with GAAP earnings per share (EPS) of $0.90 and non‑GAAP EPS of $0.23. GAAP gross margin improved to 38.2% (non‑GAAP 40.0%), a sharp recovery from last year’s trough. Management emphasized two themes: disciplined balance‑sheet repair and a widening set of artificial intelligence (AI) opportunities across central processing units (CPUs), accelerators, and Intel Foundry. “AI is accelerating demand for compute and creating attractive opportunities across our portfolio,” CEO Lip‑Bu Tan said, while CFO David Zinsner added, “Current demand is outpacing supply, a trend we expect will persist into 2026.”

Intel guided Q4’25 revenue to $12.8–$13.8 billion and non‑GAAP EPS to $0.08 (GAAP EPS of –$0.14), noting that guidance excludes Altera following its deconsolidation in September. The company bolstered liquidity with $5.7B in U.S. government funding this quarter (part of a broader $8.9B commitment), plus strategic equity from NVIDIA ($5.0B, expected to close in Q4) and SoftBank Group ($2.0B). Cash and short‑term investments ended the quarter at $30.9B.

Growth Opportunities

AI everywhere, x86 in the mix. Intel’s pitch is less “GPU or bust” and more “hybrid compute,” where x86 CPUs remain the traffic cops for data‑center AI—routing, orchestrating, and increasingly handling inference alongside accelerators. On the PC side, the ongoing Windows 11 refresh and early AI PC adoption are tailwinds; Intel expects the 2025 client consumption total addressable market (TAM) to approach 290 million units, marking a second straight year of growth.