⚡ Capacity Crunch & AI Acceleration: AMD Levels Up, Navitas Reboots, Super Micro Doubles Down

Welcome, AI & Semiconductor Investors,

AMD’s groundbreaking 6-gigawatt deal with OpenAI signals a seismic shift in the AI semiconductor wars, potentially unlocking over $100 billion in future revenues. Meanwhile, Navitas Semiconductor makes a bold bet on high-voltage AI infrastructure, and Super Micro Computer rides a record $13 billion order wave.— Let’s Chip In.

What The Chip Happened?

🤖 AMD Levels Up—OpenAI Mega-Deal Fuels an AI Renaissance

⚡ Navitas Powers Up with Strategic Pivot to High-Voltage AI Future

🔥 Super Micro’s Mega-Scale Moment: Q2 Revenue Set to Double After Historic $13B Order Wave

Read time: 7 minutes

NEW SEMICONDUCTOR COMMUNITY — 50% OFF FOUNDING RATE

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Advanced Micro Devices (NASDAQ: AMD)

🤖 AMD Levels Up—OpenAI Mega-Deal Fuels an AI Renaissance

What The Chip: AMD dropped its Q3 earnings on November 4, 2025, reporting record revenue of $9.2 billion (+36% YoY, +20% QoQ). A colossal multi-year partnership with OpenAI to deploy 6 gigawatts of AMD’s Instinct GPUs, kicking off with 1 GW of MI450 Series accelerators in 2H26. CEO Lisa Su confidently projects AI-driven revenues to soar into “tens of billions” by 2027, transforming AMD into an undisputed heavyweight in AI computing.

Details:

🚀 AI’s New Heavyweight: AMD’s multi-year partnership with OpenAI is no ordinary deal, it’s massive, deploying 6 gigawatts of Instinct GPUs starting mid-2026. Management boldly called out potential revenues exceeding $100 billion in coming years from similar deals, positioning AMD as a dominant player in the AI compute market.

🖥️ Unexpected CPU Renaissance: AI isn’t just GPUs anymore. Hyperscalers, including major cloud providers, are now significantly ramping up CPU builds to handle the surging AI workload demand. This newfound CPU boom, described as a “multi-quarter phenomenon,” aligns perfectly with AMD’s rollout of its high-performance 5th Gen EPYC Turin processors, already representing nearly half of EPYC revenues.

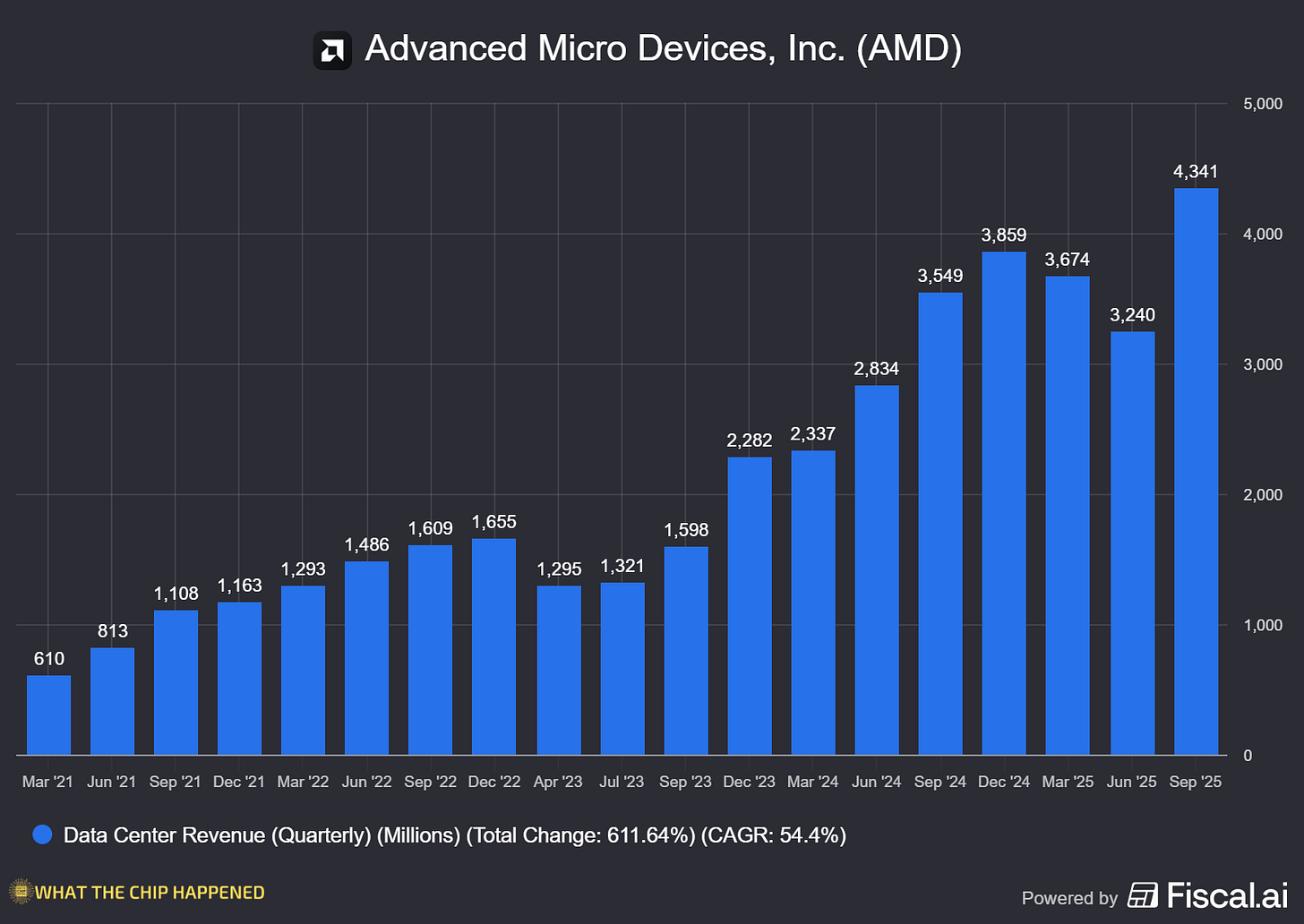

📈 Record-Breaking Financial Performance: AMD delivered robust Q3 results, posting non-GAAP diluted EPS of $1.20 (+30% YoY). Total revenue reached $9.2 billion (+36% YoY), with the Data Center segment leading the charge at a record $4.34 billion (+34% QoQ). Impressively, AMD generated $1.53 billion in free cash flow, more than triple last year’s figure.

🔧 AI Scale and Supply Challenges: Scaling 6 gigawatts isn’t trivial. AMD acknowledges “tight” supply chain constraints across silicon, memory, power, and advanced packaging, which introduces execution risks over the next two years. While management remains optimistic, investors should keep an eye on these critical bottlenecks.

⚔️ David vs. Goliath in AI Accelerators: AMD faces intense competition from NVIDIA, especially as it battles for massive hyperscale deployments. The current guidance notably excludes revenue from MI308 GPU shipments to China due to export controls—a significant headwind investors should monitor closely.

🎮 Client and Gaming Rebound: AMD’s client and gaming segments crushed it, hitting a record $4.05 billion (+73% YoY). Gaming alone surged 181% YoY, underlining strong demand and market leadership in consumer markets.

🖥️ Full-Stack AI Platform Advantage: AMD’s secret weapon? Its unique full-stack approach. AMD isn’t just offering GPUs—it’s delivering fully integrated rack-scale solutions (Helios) combining GPUs (MI450), CPUs (2nm Venice), and Pensando networking, optimized for performance and efficiency. This strategy, bolstered by recent acquisitions like ZT Systems, could cement long-term customer lock-in.

💡 Software Breakthrough with ROCm: AMD’s previously lagging software stack, ROCm, is finally gaining developer traction. Third-party heavyweights like Hugging Face and vLLM are directly contributing to ROCm 7. This signals a crucial tipping point for AMD, potentially narrowing the software ecosystem gap with NVIDIA’s CUDA.

Why AI/Semiconductor Investors Should Care:

This quarter’s results signal that AMD isn’t just riding the AI wave, it’s carving out a substantial chunk of the market. The OpenAI deal is transformative, not only due to sheer size but because AMD is uniquely positioned to deliver integrated solutions that could deepen customer lock-in and raise competitive barriers. While execution risks from the ambitious scale-up remain real, AMD’s aggressive R&D investments, software improvements, and CPU resurgence driven by AI workloads collectively suggest a strong, durable growth trajectory.

NEW SEMICONDUCTOR COMMUNITY — 50% OFF FOUNDING RATE

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Navitas Semiconductor (NASDAQ: NVTS)

⚡ Navitas Powers Up with Strategic Pivot to High-Voltage AI Future

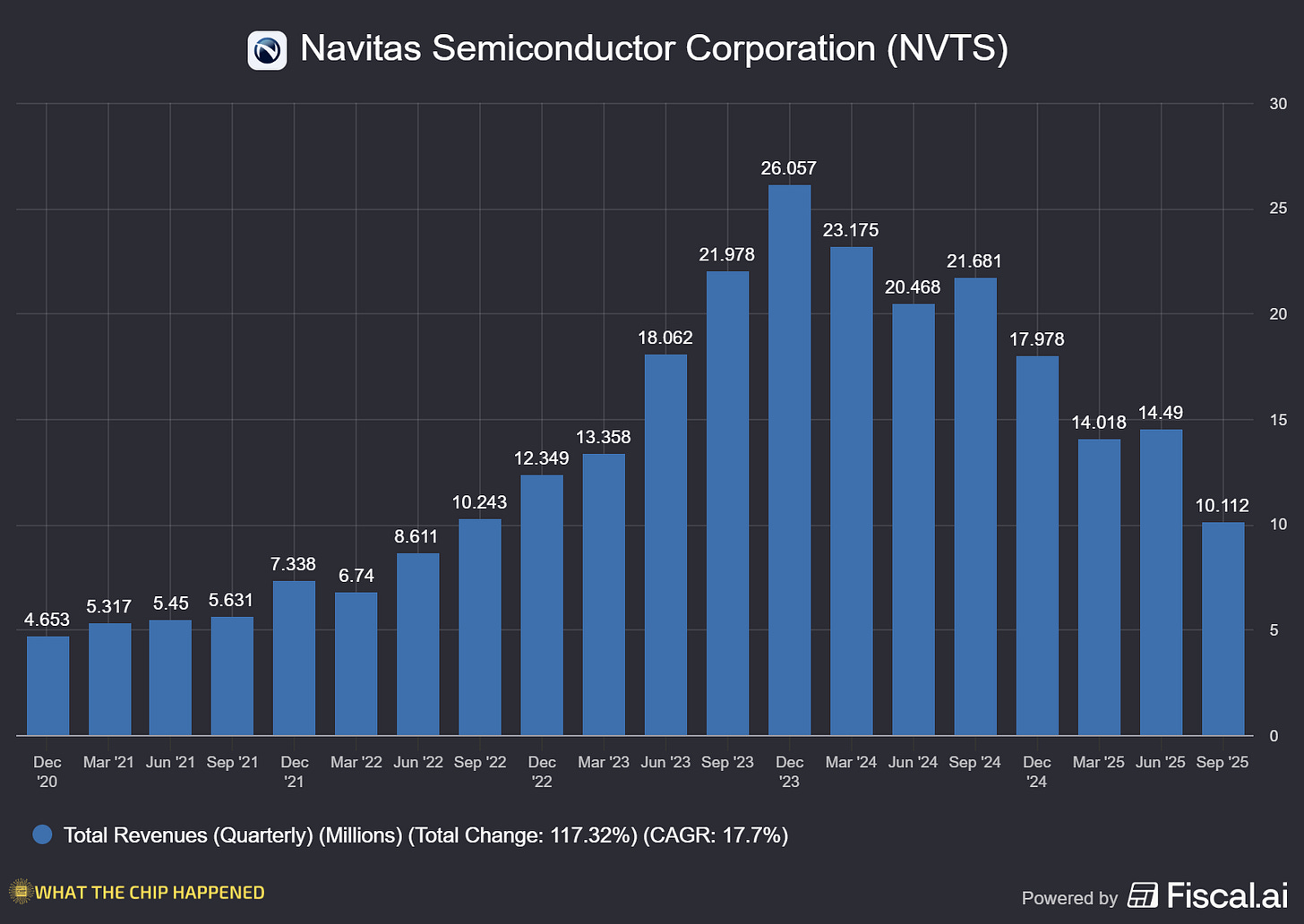

What The Chip: Navitas Semiconductor just announced a decisive pivot away from consumer and mobile markets towards high-power applications, as new CEO Chris Allexandre called this “a crucial moment” for the company. The move, unveiled in their Q3 earnings on November 4, 2025, involves restructuring operations to fully embrace AI data centers, grid infrastructure, performance computing, and industrial electrification.

Details:

📉 Painful Pivot in the Short-term: Navitas expects Q4 revenue to hit a bottom of about $7.0M—down 31% sequentially and 67% year-over-year. Management openly acknowledged intentionally walking away from revenue, particularly in China mobile, due to lower margins and tariff pressures on silicon carbide (SiC).

🤖 Validated by NVIDIA: Navitas received a critical endorsement from NVIDIA at the recent OCP Global Summit, being named a preferred power semiconductor partner for NVIDIA’s cutting-edge 800V DC AI data center architecture. CEO Chris Allexandre highlighted that Navitas is uniquely positioned to handle the power path “from the grid to the GPU,” marking a strong validation of its technology.

🔋 Material Revenue Pushes to 2027: While Navitas already ships into AI data centers, substantial revenue won’t appear on the financial statements until 2027, when the 800V DC architecture adoption becomes mainstream. Investors should expect 2026 to be a foundational year of design wins rather than significant revenue growth.

🚀 AI-Electrification Tailwind: Allexandre underscored AI as a powerful catalyst driving accelerated demand not just in data centers but also high-performance computing and industrial markets. Navitas believes this trend will accelerate demand well ahead of the major 800V ramp, creating multiple growth opportunities throughout 2026.

🎯 Complete High-Power Portfolio Advantage: Navitas differentiates itself with a comprehensive suite of power products—from GaN ICs at lower voltages (100V for mid-voltage AI server power) to high-voltage SiC modules (2.3kV-3.3kV) for energy storage and grid infrastructure. This breadth is critical, as it allows deeper, multi-subsystem engagements, increasing margins and revenue predictability.

💸 Financial Health Check:

Q3 revenue dropped to $10.1M, down 53% YoY, as the mobile business shrinks.

Non-GAAP gross margin was relatively stable at 38.7% despite plunging revenues.

Net loss of $10.2M (non-GAAP), mitigated by reduced operating expenses and strengthened cash position ($150.6M cash, zero debt) thanks to a recent $100M capital raise.

Why AI/Semiconductor Investors Should Care:

Navitas’ pivot is bold and painful in the short term, but it positions the company squarely in the high-value future of power semiconductors driven by AI. The strategic NVIDIA partnership and the shift towards 800V DC data center architectures are transformative trends investors cannot ignore. While 2026 will test investor patience with gradual, foundational growth, the real acceleration and payoff emerge in 2027, making Navitas a name to closely track for investors targeting the next big wave in AI infrastructure growth.

Super Micro Computer (NASDAQ: SMCI)

🔥 Super Micro’s Mega-Scale Moment: Q2 Revenue Set to Double After Historic $13B Order Wave

What The Chip: On November 4, 2025, Super Micro Computer announced Q1 FY2026 results featuring a surprising revenue miss at $5 billion—but that’s not the headline. A massive $1.5 billion revenue shift from Q1 to Q2, sparked by customer upgrades to its cutting-edge GB300 AI platform, turns next quarter into a blockbuster. With full-year guidance boosted to at least $36 billion (up from $33 billion), this quarter marks a pivotal moment in Super Micro’s journey into mega-scale territory.

Details:

🚀 Historic $13 billion order backlog: Super Micro secured a record $13 billion in new orders during Q1—its largest-ever deal pipeline. Most of this backlog is tied to NVIDIA’s Blackwell Ultra (GB300) AI platform, setting the stage for rapid growth through FY2026.

🌐 Revenue doubles next quarter: After the Q1 shortfall, Super Micro guided Q2 revenue to a massive $10-11 billion, doubling sequentially. This isn’t just a bounce-back—it’s driven by large-scale AI platform deployments to hyperscalers, showing strong customer demand.

⚡ Mega-scale manufacturing ramp: Production capacity is scaling aggressively, now reaching 6,000 racks per month, half featuring advanced Direct Liquid Cooling (DLC). With theoretical annual capacity surpassing $100 billion, Super Micro is positioned for substantial market-share gains, albeit with near-term margin pressures.

📉 Margins under near-term pressure: Q2 gross margins are expected to drop 300 basis points to approximately 6.5% due to customer mix and upfront investment in mega-scale deals. CFO David Weigand explained, “We’re ramping one of the largest clusters in the world,” indicating deliberate short-term margin sacrifice to secure strategic mega-scale relationships.

💸 Cash flow strains intensify: Operating cash flow swung sharply negative (-$918 million), pushing Super Micro from net cash to a $575 million net debt position. Management acknowledged the strain, securing an $1.8 billion receivables facility and promising tighter control of growth aligned with available working capital.

🔍 DCBBS: High-margin future: CEO Charles Liang highlighted their high-margin Data Center Building Block Solutions (DCBBS) as essential for future profitability. Unlike commodity servers, DCBBS solutions—including advanced cooling and power management—are key to margin recovery, especially as they ramp up capacity.

🌏 Geographic shift—Asia rising: Revenue from Asia soared 143% YoY to 46% of total revenue, driven by a U.S.-based hyperscaler expanding aggressively in Asia. Meanwhile, U.S. revenues fell sharply (down 57% YoY), highlighting shifting customer deployments globally.

🎯 Strategic confidence despite hurdles: Even amid short-term pressures, CEO Liang described the revised $36 billion full-year target as “very conservative,” emphasizing growing confidence in sustained demand far beyond FY2026.

Why AI/Semiconductor Investors Should Care:

Super Micro’s strategic bet—sacrificing near-term margins to win mega-scale AI deals—could significantly reshape the company’s competitive position. While cash flow and margin deterioration pose immediate risks, the massive GB300 backlog and advanced DCBBS solutions provide long-term margin expansion opportunities. Investors must closely monitor the company’s execution: if Super Micro can convert short-term pain into sustained mega-scale customer relationships, its current strategy could unlock substantial long-term gains.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

NEW SEMICONDUCTOR COMMUNITY — 50% OFF FOUNDING RATE

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.