🏗️ Capacity Crunch: Microsoft & Alphabet's Mega CapEx Surge, Meta's Compute Hunger Unleashed

Welcome, AI & Semiconductor Investors,

Microsoft just inked a landmark $250 billion Azure deal with OpenAI, but warned that even record CapEx won’t fully meet demand. Alphabet’s historic $100B quarter underscores AI’s explosive monetization, while Meta bets bigger still—preparing an unprecedented compute surge— Let’s Chip In.

What The Chip Happened?

🚧 Capacity Is the New Currency — Q1 FY26: Azure Soars, OpenAI Locks in $250B

🎛️ Alphabet’s $100B Moment: All-In on AI, Tight on Supply

🧠 Meta’s Super-Compute Sprint: Big Brain, Bigger Bill

[Microsoft FY26 Q1: Cloud & AI Lift a $77.7B Quarter]

Read time: 7 minutes

NEW SEMICONDUCTOR COMMUNITY — 50% OFF FOUNDING RATE

Microsoft (NASDAQ: MSFT)

🚧 Capacity Is the New Currency — Q1 FY26: Azure Soars, OpenAI Locks in $250B

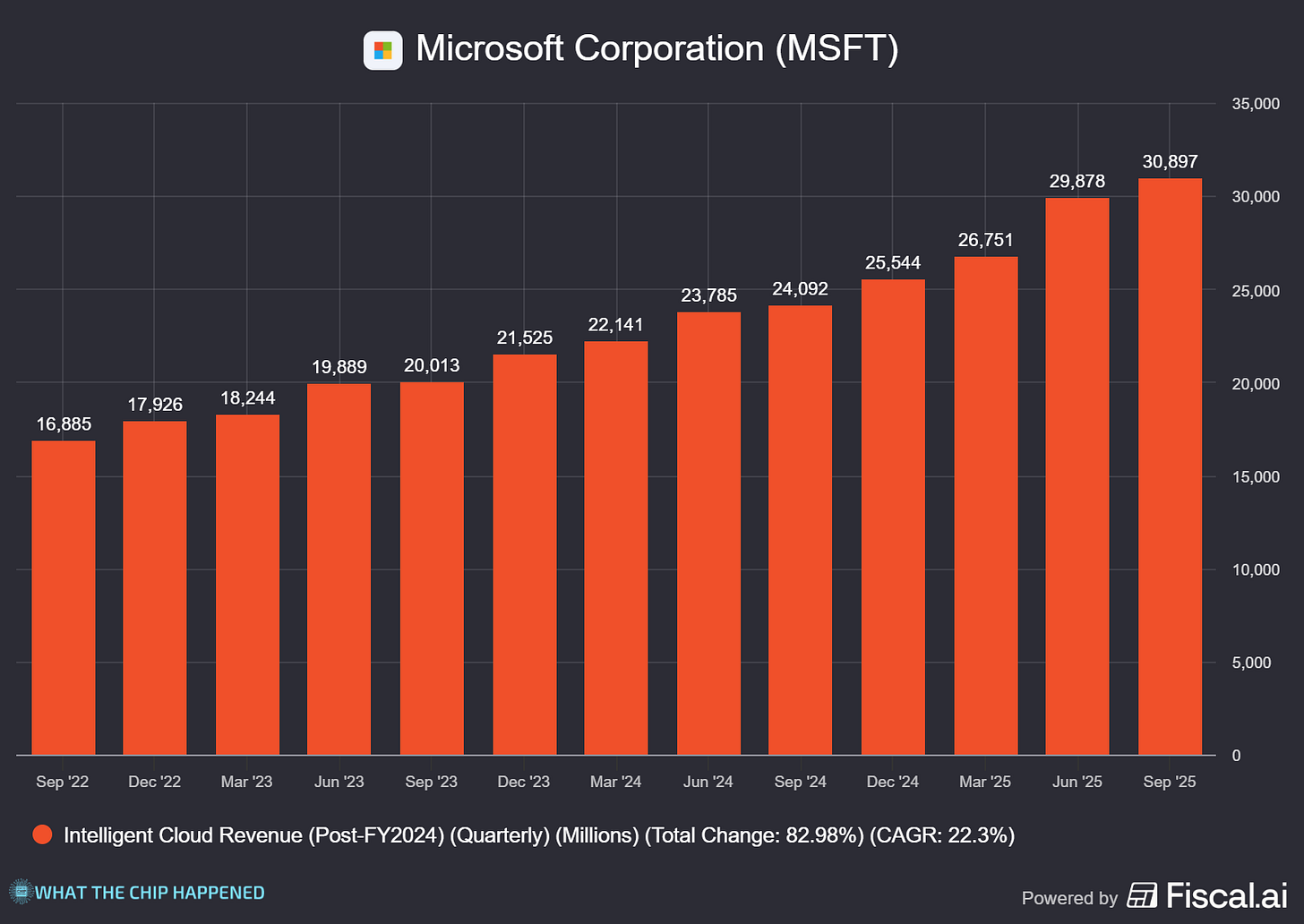

What The Chip: Microsoft posted Q1 FY2026 results on October 29, 2025 with Azure up 40% and a fresh warning: demand is running ahead of supply through fiscal year-end. A day earlier (Oct 28), Microsoft and OpenAI signed a definitive deal that includes $250B of incremental Azure commitments and extends Microsoft’s access to OpenAI model IP, reshaping revenue visibility for years.

Details:

💥 Demand > Supply. CFO Amy Hood said, “In Azure, we expect Q2 revenue growth of approximately 37% in constant currency as demand remains significantly ahead of the capacity we have available… we now expect to be capacity constrained through at least the end of our fiscal year.” Translation: Microsoft is deliberately throttling some external workloads to feed first‑party apps, R&D, and required server replacements.

🏗️ Capex dialed up—again. Q1 capex hit $34.9B (+74% y/y). Roughly half went to short‑lived GPUs/CPUs, and Microsoft recorded $11.1B in finance leases for longer‑lived assets. Management now expects FY26 capex growth to exceed FY25, reflecting an all‑out build to meet AI demand.

🧱 Building a bigger factory. Satya Nadella (CEO) said Microsoft will increase total AI capacity by >80% this year and plans to roughly double its data‑center footprint in two years—evidence the spending isn’t just GPUs, it’s entire regions coming online.

🤝 OpenAI deal = moat + visibility. The new agreement gives Microsoft an approx. 27% stake in OpenAI’s public‑benefit corp and includes $250B incremental Azure consumption. Microsoft retains rights to OpenAI models/products through 2032, with an independent panel now validating any claim of AGI. (Microsoft also dropped a prior “right of first refusal” even as it tightens the tie on Azure usage.)

📚 Bookings & backlog exploded. Commercial bookings +112% y/y, primarily on Azure commitments from OpenAI. Commercial RPO reached $392B (+51%) with a ~2‑year weighted average duration—short enough to matter for near‑term revenue.

📊 Margin math: investment first. Overall gross margin stayed high at ~69%, but Microsoft Cloud margin was 68% this quarter, and Hood guided ~66% next quarter as AI scale‑out mixes in and depreciation ramps.

🧠 AI usage at platform scale. Nadella: “We increased token throughput for GPT‑4.1 and GPT‑5 by >30% per GPU this quarter.” First‑party Copilots now >150M MAUs; Microsoft says AI features reach ~900M monthly users; GitHub Copilot tops 26M users.

🗣️ How Microsoft is thinking about monetization. Nadella framed AI as expanding categories, not just raising ARPU: “You could say our ARPUs are too low for M365—or you could say AI lets us be much more expansive… coding goes from tools to one of the most expansive AI systems… same with security and consumer—it’s ads plus subscriptions.”

Why AI/Semiconductor Investors Should Care

Microsoft’s message is clear: it will sacrifice some near‑term margin to secure a durable AI edge in infrastructure and the application layer (Copilot/agents). The $250B OpenAI commitment plus $392B RPO compresses uncertainty on future Azure revenue, while persistent capacity constraints imply upside when supply actually catches up. Watch for signals that constraints ease (H2 FY26/FY27) and for agentic‑AI attach rates across M365, GitHub, and Security—if usage converts to paid seats at scale, Microsoft’s margin headwinds can flip to operating leverage.

NEW SEMICONDUCTOR COMMUNITY — 50% OFF FOUNDING RATE

Alphabet (NASDAQ: GOOGL)

🎛️ Alphabet’s $100B Moment: All-In on AI, Tight on Supply

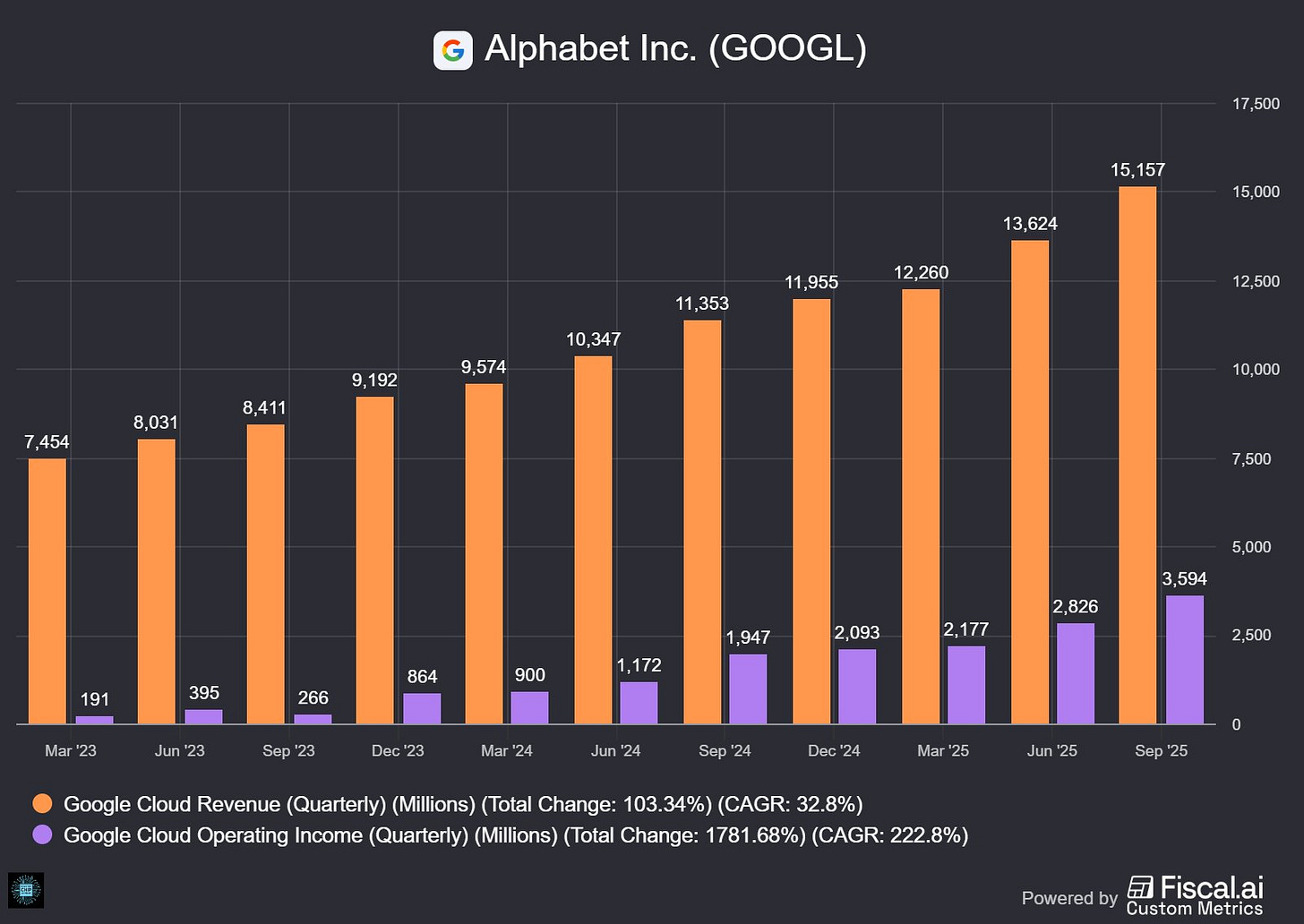

What The Chip: Alphabet posted its first-ever $100B+ quarter on October 29, 2025, and promptly raised 2025 CapEx to $91–93B as it races to build AI capacity. Management says 2026 spend goes higher from here.

Details:

💾 CapEx = commitment. 2025 CapEx guide jumps to $91–93B (from $85B) to fund data centers, GPUs/TPUs, and networking. Q3 purchases of property & equipment hit $23.95B, up ~83% YoY (vs. $13.06B in Q3’24). CFO Anat Ashkenazi (Alphabet CFO since July 2024) added 2026 will see a “significant increase.” Depreciation rose to $5.6B (+41% YoY) and will “accelerate slightly” in Q4. Translation: near‑term margin pressure in service of capacity.

☁️ Cloud is the growth engine. Google Cloud revenue: $15.2B (+34% YoY); operating income: $3.6B (+85%); operating margin: 23.7%. The Cloud backlog hit $155B and, importantly, management said it was up 46% QoQ and 82% YoY—evidence of enterprise AI demand converting into signed commitments.

🚦 Capacity remains the bottleneck. Alphabet expects to “remain in a tight demand‑supply environment” in Q4 and into 2026 for AI infrastructure. That’s bullish for long‑term revenue but constrains near‑term monetization if customers can’t get capacity when they want it.

🔎 AI is expanding Search, not just shifting it. CEO Sundar Pichai said overall and commercial queries grew faster in Q3 thanks to AI Overviews and AI Mode. AI Mode now has >75M daily active users, with queries doubling in Q3. CBO Philipp Schindler added “AI Max unlocked billions of net new queries” in the quarter—fresh ad inventory, not just reshuffled demand. (AI Mode = conversational, agentic search; AI Overviews = generative summary atop results.)

📺 Ads solid—but Q4 comps get tricky. YouTube ads: $10.3B (+15% YoY), yet management cautioned Q4 advertising comps will be tough due to heavy 2024 U.S. election spend, especially on YouTube. Expect deceleration optics even if fundamentals hold.

🧠 Model/compute scale is staggering. Pichai: first‑party models like Gemini now process ~7B tokens per minute via direct API usage; across Google surfaces the company is processing >1.3 quadrillion tokens per month (>20× YoY). Gemini app surpassed 650M MAUs; paid subs >300M. That’s durable usage to monetize across Cloud, Ads, and Workspace.

🧱 Regulatory and cost headwinds linger. Q3 included a $3.5B EC fine, which dragged reported margin to 30.5% (would be 33.9% ex‑fine). Management also flagged higher technical infrastructure operating costs (e.g., energy) as AI build‑out scales.

🧩 Full‑stack differentiation. Pichai emphasized Alphabet as “the only Cloud provider offering our own leading generative AI models,” alongside custom TPUs and NVIDIA GPUs—vertical integration that can sustain Cloud margins as scale ramps. Also: 13 Cloud product lines now run at >$1B ARR each.

Why AI/Semiconductor Investors Should Care

Alphabet is turning AI from promise to P&L. Cloud backlog acceleration (+46% QoQ) and ads fueled by AI‑driven query growth point to multi‑year revenue compounding, while 23.7% Cloud margin and full‑stack control (models + TPUs + infra) support structurally better unit economics than a resell‑only approach. The trade‑off: CapEx and depreciation will compress margins near‑term, and capacity tightness into 2026 could defer some Cloud revenue. If Alphabet executes its build‑out on time, investors get a bigger, higher‑quality cash engine on the other side—one where AI features monetize at roughly Search‑like rates today, with upside as new ad formats mature.

Meta Platforms (NASDAQ: META)

🧠 Meta’s Super-Compute Sprint: Big Brain, Bigger Bill

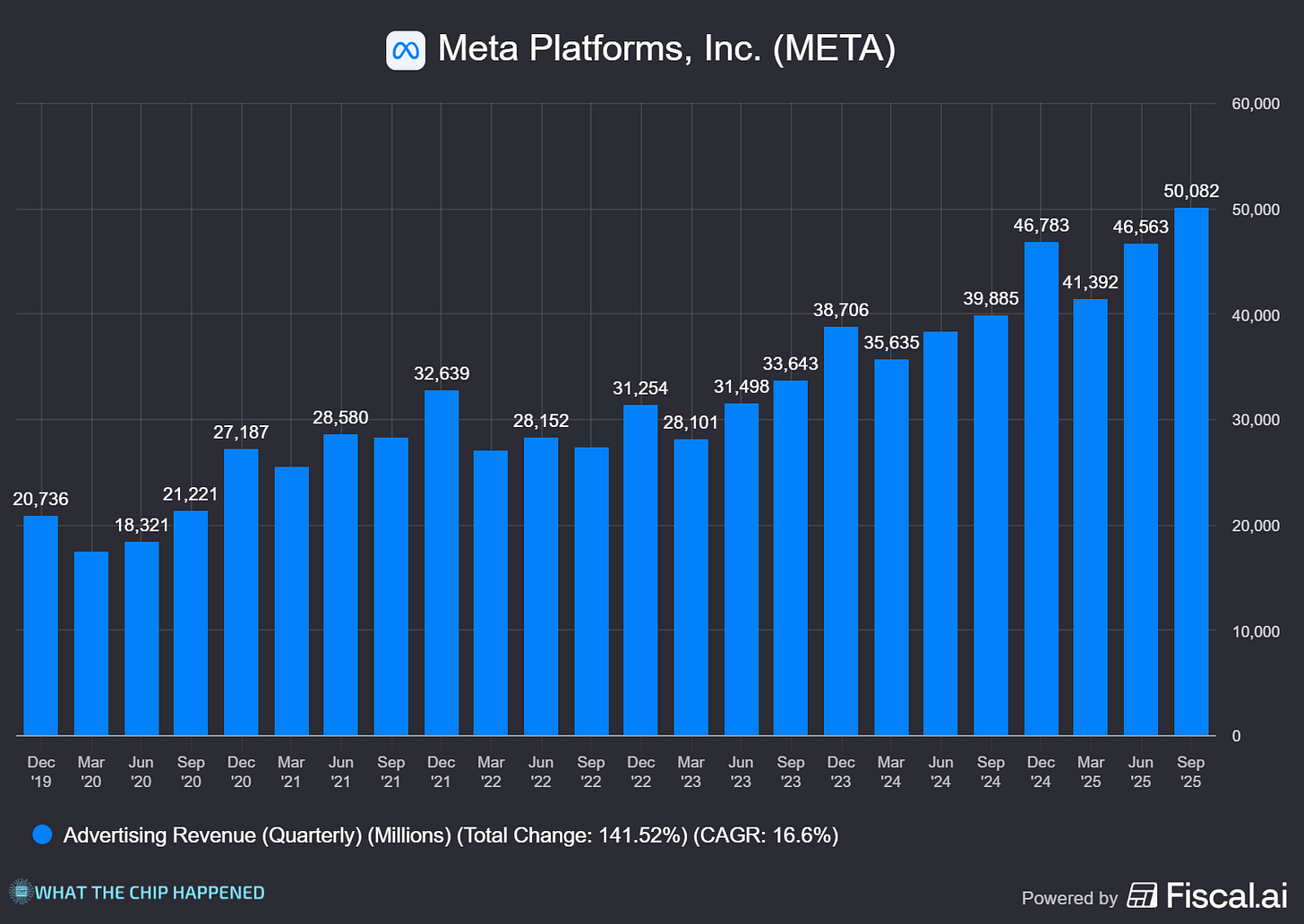

What The Chip: On October 29, 2025, Meta lifted its 2025 CapEx outlook to $70–$72B (from $66–$72B), flagged even larger CapEx in 2026, and warned that EU ad rule changes could ding revenue as soon as Q4. The thread through it all: Meta says its compute needs expanded meaningfully vs. last quarter’s plan.

Details:

💾 Compute floodgates opening. CFO Susan Li said “capex dollar growth will be notably larger in 2026 than 2025,” with total expenses growing at a significantly faster rate next year—driven by infrastructure (cloud + depreciation) and AI-heavy headcount. Translation: the data-center build is just getting started. 2025 CapEx: $70–$72B.

💸 Profit optics vs. tax reality. Q3 revenue hit $51.24B (+26% y/y) and operating margin landed at 40%. Reported EPS fell to $1.05 after a $15.93B one‑time tax charge tied to the One Big Beautiful Bill Act; ex‑charge EPS would be $7.25. Free cash flow: $10.62B; Q3 CapEx: $19.37B; buybacks: $3.16B; dividends: $1.33B.

📈 Ad engine keeps humming. Ad impressions +14%; average price/ad +10%; FoA ad revenue $50.08B (+26%). The family hit 3.54B daily active people in September. Inside the apps: time spent +5% on Facebook and +10% on Threads; video time on Instagram +30% vs. last year.

🧲 Three AI revenue magnets. Reels now runs at >$50B annualized; Meta’s end‑to‑end AI ad tools crossed $60B run rate; Click‑to‑WhatsApp ads +60% y/y. CEO Mark Zuckerberg added: “More than a billion monthly actives already use Meta AI.” He also teased a “single unified AI system” spanning Facebook, Instagram, and ads.

👓 AI wearables find a pulse. New Ray‑Ban Meta Display glasses “sold out in almost every store within 48 hours,” with demo slots booked through next month. Management plans to increase manufacturing.

🧑⚖️ Regulatory clouds. Meta cautioned that European Commission changes to its Less Personalized Ads offering “could have a significant negative impact” on EU revenue as early as this quarter; youth‑related U.S. trials in 2026 “may ultimately result in a material loss.”

🧠 Compute hunger, not a fad. Zuckerberg: Meta is “building what we expect to be an industry‑leading amount of compute” and the core business “continues to be able to profitably use much more compute than we’ve been able to throw at it.” That’s the strategic rationale for front‑loading spend.

🔭 Q4 outlook. Meta guides Q4 revenue to $56–$59B, assumes a ~1% FX tailwind, and expects a 12–15% tax rate. Also noted: Q4 Reality Labs revenue likely down y/y due to headset timing (holiday channel fill pulled into Q3).

Why AI/Semiconductor Investors Should Care

Meta just put a multi‑year purchase order on compute—servers, data centers, and network infrastructure—and says 2026 spend accelerates further. That supports demand not only for accelerators/GPUs but also for HBM memory, optical networking, power gear, and data‑center construction. The near‑term trade‑off is margin pressure from depreciation and cloud costs, plus EU ad uncertainty that could shave top‑line in the next quarter—but if Meta’s unified AI and rec‑systems roadmap keeps lifting ad ROI and engagement, the infrastructure will have a long runway to monetize.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

NEW SEMICONDUCTOR COMMUNITY — 50% OFF FOUNDING RATE

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Good morning, Jose. I received an email from you, I don't know, two or three days ago, titled. "Massive Update To Your Yearly Newsletter Subscription"You asked me to respond, telling you how I wish to proceed with my subscription and gave me three options. Unfortunately, where the email address to respond to should have been, there was only a placeholder. Could you send me the correct email address to respond to? If you prefer, my response to the email was going to be option three, and you can just send me the code and how I proceed to pay you the additional money for the new subscription.

Thank you very much,

Harold Lee Darter