[FREE PREMIUM] Oracle Earnings Deep Dive

Welcome, AI & Semiconductor Investors,

🎁 This week’s FREE premium report is here. This is the same deep-dive analysis our community members get, yours at no cost. Want the numerous reports per week, plus live Q&A, and the full community? Less than $0.70/day with code CHIPS at CLICK HERE

Now let’s get into it. — Let’s Chip In.

What The Chip Happened?

Join WhatTheChipHappened Community — 15% OFF Annual Use Code “CHIPS”

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Executive Summary

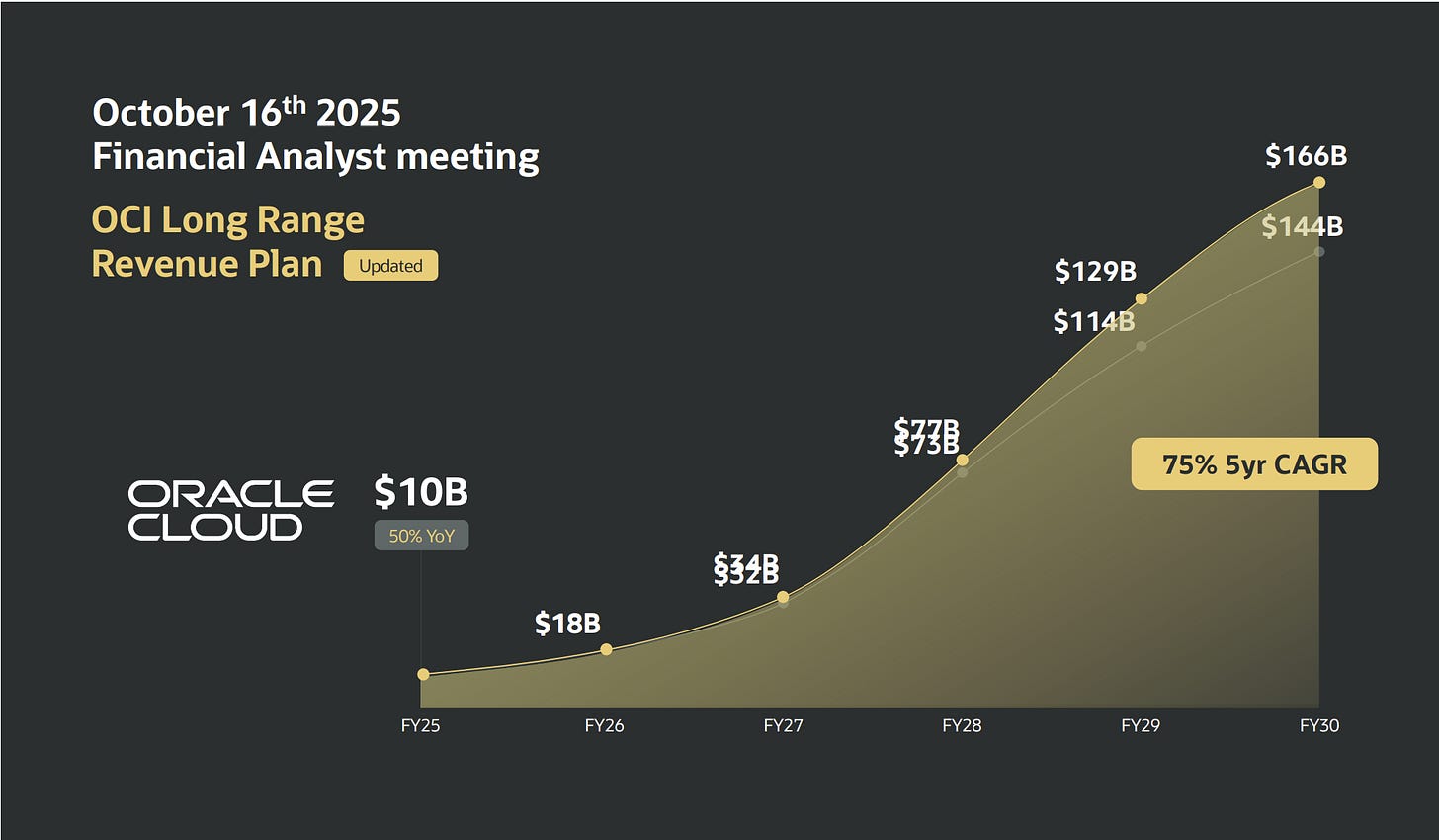

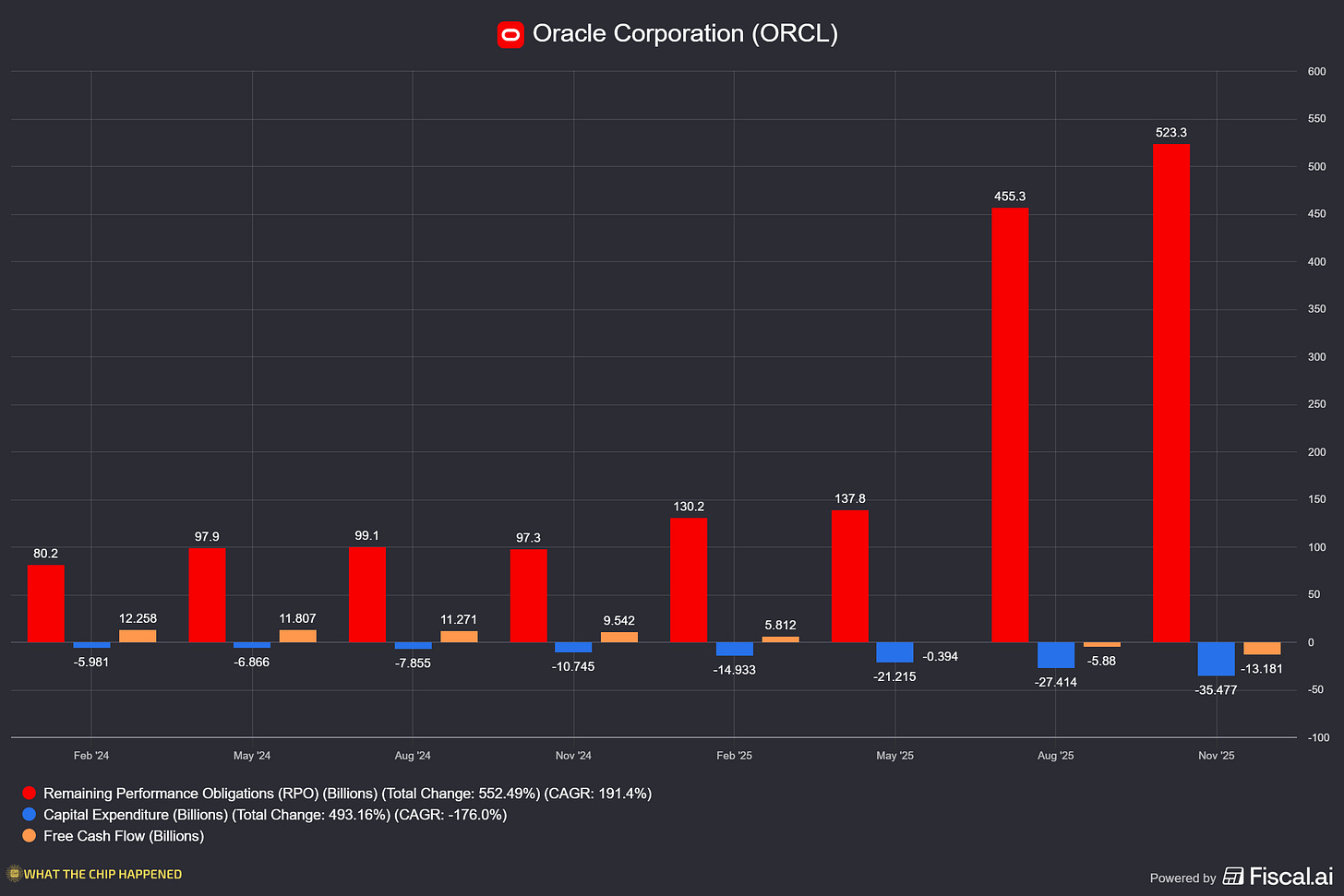

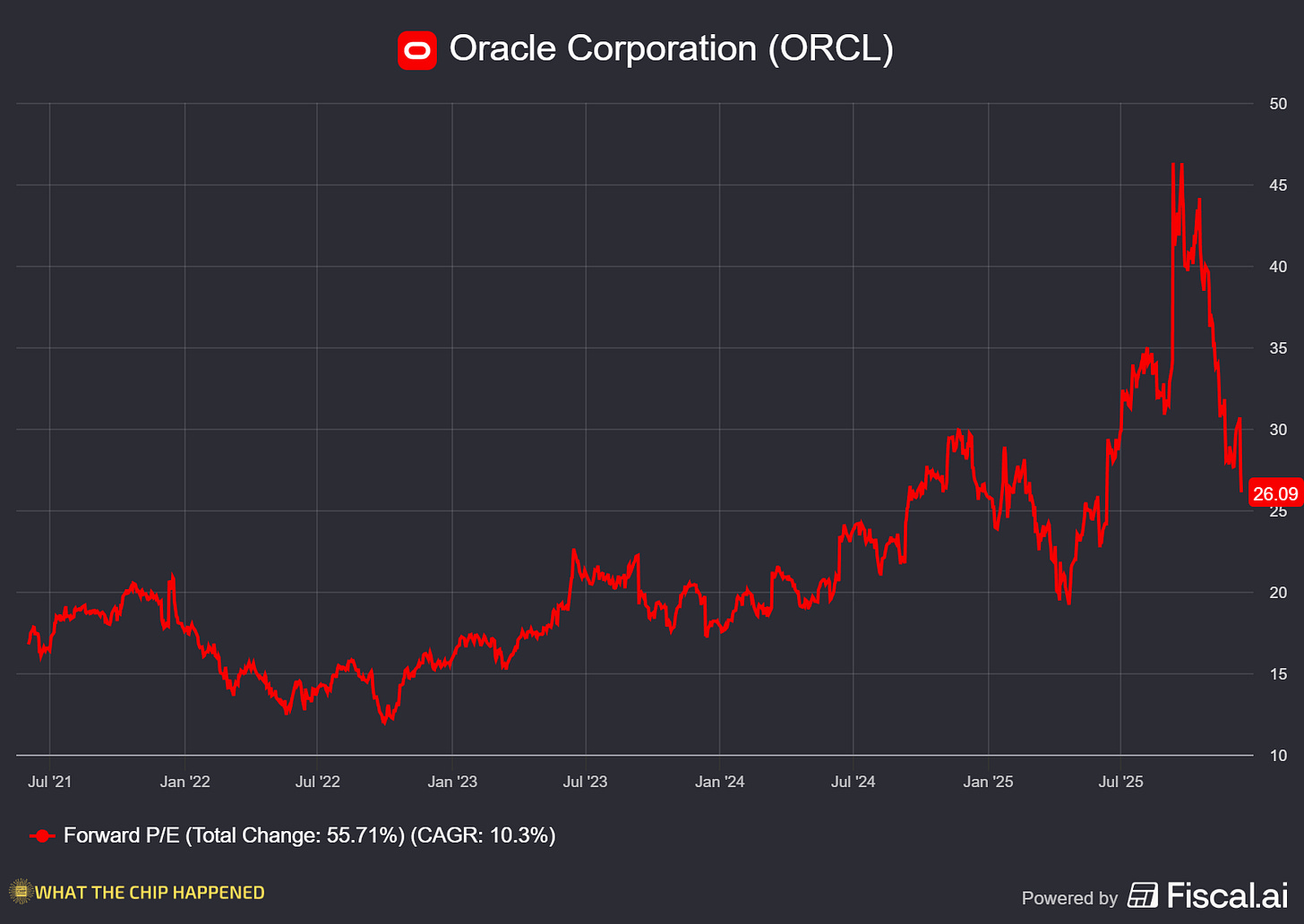

Oracle delivered a quarter that spooked investors despite extraordinary demand signals. Revenue of $16.1B (+13% YoY constant currency) came in slightly light of expectations, while non-GAAP EPS of $2.26 (+51% YoY) was boosted by a $2.7B one-time gain from selling Oracle’s Ampere stake. The story I’m following isn’t the revenue print; it’s the $68 billion in new RPO signed in a single quarter from Meta, NVIDIA, and others, pushing total backlog to $523B (+433% YoY). Management responded by hiking FY26 CapEx guidance by $15B, triggering a double-digit stock drop as investors digested the cash burn implications. The market wanted AI revenue now; Oracle delivered AI contracts for later (luckily for those that listen to investor analyst events, this isn’t a surprise, the AI revenue is coming in steps).

Why This Quarter Mattered

Investors came in focused on three questions: Can Oracle convert its massive backlog to recognized revenue? How bad is customer concentration risk beyond OpenAI? And how much capital will this AI buildout actually require? This quarter partially answered all three. The Meta and NVIDIA contract announcements diversified the customer narrative. Still, management’s admission that funding needs will be “substantially less than $100B” while raising near-term CapEx by $15B didn’t fully calm financing concerns. The modest revenue result reinforced concerns that investors continually expect incremental CapEx to drive incremental revenue faster than current reality allows.

Join WhatTheChipHappened Community — 15% OFF Annual Use Code “CHIPS”

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Key Takeaways

RPO Explosion Validates AI Positioning: Oracle added more contracted backlog in one quarter than many cloud companies generate annually, driven by contracts with Meta, NVIDIA, and others. Total backlog growth of 433% YoY is unprecedented at Oracle’s scale. [This is the de-risking disclosure bulls needed; the concentration narrative shifts from “OpenAI dependency” to “hyperscaler magnet.”]

Revenue-Backlog Disconnect Concerns Investors: Despite record bookings, revenue grew only 13% and came in slightly light. Management expects incremental FY27 revenue from Q2 bookings, but the lag between signing and recognizing is frustrating a market that wants AI revenue now. [The conversion timeline, not demand, is the issue.]

CapEx Guidance Jumps $15B: Oracle raised FY26 CapEx expectations significantly above Q1 forecasts to convert near-term capacity opportunities. Combined with a negative $10B quarterly free cash flow, this is one of the factors that triggered the post-earnings selloff. [The market heard “we need to spend more” not “we have more profitable deals to fund.”]

Alternative Financing Models Underappreciated: Management emphasized customer-owned chips (no Oracle CapEx) and vendor rental models (payments sync with receipts) as reasons they’ll need substantially less external funding than analyst estimates. But they didn’t quantify the mix, leaving investors guessing. [This is either a legitimate capital efficiency story or hand-waving, we need more disclosure to know which.]

GPU Capacity Delivery Accelerating: Oracle delivered 50% more GPU capacity vs. Q1, with the Abilene Supercluster on track and AMD MI355 deliveries begun. Capacity transfers between customers in hours due to bare metal architecture. [The fungibility point addresses counterparty risk concerns directly.]

Applications Acceleration Defies SaaS Gravity: Cloud apps deferred revenue is growing faster than recognized revenue, a leading indicator of acceleration. Oracle’s unified sales organization combining industry and Fusion teams is driving larger, multi-component deals. [Every large SaaS peer is decelerating; Oracle claims to be accelerating. The deferred revenue spread supports the claim.]

AI Data Platform Is the Long Game: Larry Ellison spent his entire prepared remarks on Oracle’s vision for AI reasoning on private enterprise data, not quarterly results. He positioned Oracle databases as containing “most of the world’s high-value private data” and called this opportunity larger than training AI on public data. [Classic Larry, ignore the quarter, sell the decade.]

Margins Compressed During Buildout: Operating income grew only 8% while revenue grew 13%. Management acknowledged that margins are temporarily lower because most capacity isn’t online yet. Path to 30-40% AI data center gross margins depends on accelerating capacity delivery, but no specific timeline was provided. [This remains the key investor concern alongside capital requirements.]

Key Quotes

“Remaining performance obligations, or RPO, ended the quarter at $523.3 billion, up 433% from last year and up $68 billion since the end of August, driven by contracts signed with Meta, NVIDIA and others as we continue to diversify our customer backlog.” — Doug Kehring, EVP & Principal Financial Officer

[The headline number that captures the entire demand story in one sentence.]

“Training AI models on public data is the largest, fastest-growing business in history. AI models reasoning on private data will be an even larger and more valuable business. Oracle databases contain most of the world’s high-value private data.” — Larry Ellison, Chairman & CTO

[The strategic thesis in three sentences—Oracle as the platform for enterprise AI, not just GPU rental.]

“We’ve been reading a lot of analyst reports, and we’ve read quite a few that show an expectation of upwards of $100 billion for Oracle to go out and kind of complete these buildouts. And based on what we see right now, we expect we will need less, if not substantially less money raised than that amount.” — Clay Magouyrk, CEO (Infrastructure)

[Directly addressing the biggest bear concern with a specific benchmark, but “substantially less” needs quantification.]

“Just moving a customer to the cloud results in a 3 to 5x annual revenue lift compared to support revenue.” — Mike Sicilia, CEO

[Hidden gem many people aren’t talking about, it quantifies the embedded growth opportunity in Oracle’s massive on-prem install base.]

“Anyone right now with a credit card can show up... and you can spin up a bare metal computer as quickly as a few minutes. And at the end of that you can turn it off, and I will recycle that, and I can hand it to another customer in less than an hour.” — Clay Magouyrk, CEO (Infrastructure)

[Addresses counterparty risk directly, that capacity isn’t stranded if a customer doesn’t pay.]

Key Metrics

Financial Performance

Total Revenue: $16.1B (+13% YoY constant currency)

Non-GAAP EPS: $2.26 (+51% YoY)

GAAP EPS: $2.10 (+86% YoY) (due to one-time Ampere Sale)

Operating Income: $6.7B (+8% YoY)

Ampere Sale Gain: $2.7B pretax (one-time)

Cloud Segment

Total Cloud Revenue: $8B (+33% YoY), now 50% of total revenue

Cloud Infrastructure (OCI): $4.1B (+66% YoY)

GPU-Related Revenue: +177% YoY

Cloud Applications: $3.9B (+11% YoY), $16B annualized run rate

Cloud Apps Deferred Revenue: +14% YoY

Infrastructure Detail

Cloud Database Services: +30% YoY

Autonomous Database: +43% YoY

Multicloud Consumption: +817% YoY

Dedicated Region & Alloy: +69% YoY

Marketplace Consumption: +89% YoY

Applications Detail

Strategic Back-Office: $2.4B (+16% YoY)

Fusion ERP: +17% | Fusion SCM: +18% | Fusion HCM: +14%

NetSuite: +13% | Fusion CX: +12%

Industry Clouds: +21% YoY

Balance Sheet & Cash Flow

RPO (Total Backlog): $523.3B (+433% YoY)

RPO Added in Q2: $68B

Short-Term RPO Growth: +40% YoY (vs. 25% prior quarter, 21% year-ago)

Operating Cash Flow: $2.1B

Free Cash Flow: -$10B

CapEx: $12B

Operational

OCI Regions Live: 147 (64 more planned)

Multicloud Regions: 45 live (27 more planned)

GPU Capacity vs. Q1: +50% QoQ

Abilene Supercluster: 96,000+ GB200 GPUs delivered

Clinical AI Agent Customers: 274 live in production

Cloud App Go-Lives: 330 in quarter

Capacity Transfer Time: Hours (customer to customer)

Time to Revenue After Expenses: Couple of months (AI data centers)

On-Prem to Cloud Revenue Lift: 3-5x annual revenue vs. support

Guidance

Q3 FY26 Revenue (USD): +19-21% YoY

Q3 FY26 Cloud Revenue (USD): +40-44% YoY

Q3 FY26 Non-GAAP EPS (USD): $1.70-$1.74 (+16-18% YoY)

Q3 FY26 Non-GAAP EPS (CC): $1.64-$1.68 (+12-14% YoY)

Currency Impact: +2-3% on revenue, +$0.06 on EPS

FY26 Revenue: $67B (unchanged)

FY26 CapEx: ~$15B higher than Q1 forecast

FY27 Incremental Revenue from Q2 RPO: $4B

Target AI Data Center Gross Margin: 30-40% over contract life

Investment Implications

For Bulls:

This quarter delivered exactly what bulls needed on the demand and diversification fronts, which was record new contracts from Meta, NVIDIA, and others, proving Oracle isn’t just an OpenAI story. The 433% YoY RPO growth and 40% short-term RPO acceleration (vs. 21% last year) provide unprecedented visibility for a company of Oracle’s scale. Applications momentum: deferred revenue growth outpacing recognized revenue, validates the unified selling strategy and AI halo effect. The infrastructure fungibility explanation that capacity can be transferred in hours directly addresses counterparty risk concerns. Management’s emphasis on alternative financing models (customer-owned chips, vendor rentals) suggests capital intensity may be lower than models assume. If you believe the funding needs will genuinely be “substantially less than $100B,” and are bullish in the AI infrastructure race, then the stock reaction creates an opportunity to own a company converting massive AI demand to contracted revenue faster than any enterprise software peer.

For Bears:

The modest revenue print validates concerns that backlog conversion takes longer than investors want. More troubling: operating income grew only 8% while revenue grew 13%, and management offered no timeline for margin normalization beyond “deliver capacity faster.” Negative $10B quarterly free cash flow and a $15B CapEx guidance increase suggest the funding story isn’t as clean as prepared remarks implied. Management’s “substantially less than $100B” claim lacks quantification, they didn’t disclose what percentage of buildout uses capital-light financing models. The sell-side pressed hard on margin timing and capital requirements, and management’s answers, while detailed, were strategically vague on specifics. With Oracle betting the balance sheet on AI infrastructure economics unproven at this scale, the post-earnings selloff suggests the market shares this skepticism until management provides more transparency on the funding mix and margin timeline.

What to Watch

Short-Term RPO Conversion: Accelerated from 21% → 25% → 40% YoY over three quarters. Continued acceleration = backlog converting to revenue. Deceleration = extended monetization timeline and bear case validation.

Cloud Apps Deferred vs. Recognized Revenue: The current spread (deferred growing faster than recognized) is the leading indicator for applications acceleration. Gap widening = acceleration thesis confirmed. Gap narrowing = sales reorg didn’t deliver.

Free Cash Flow Trajectory: -$10B in Q2 with $12B CapEx. As capacity comes online (couple of months from expense to revenue), this should improve. Continued cash burn at this rate = funding concerns intensify. Inflection to positive = narrative shifts.

Alternative Financing Mix Disclosure: Management needs to quantify what percentage of buildout uses customer-owned chips and vendor rental models vs. Oracle-funded CapEx. Without this, the “<$100B funding” claim remains unverifiable.

My Thoughts

I own Oracle and I’m bullish on it, but that doesn’t mean I think the stock goes up in a straight line. The optics right now look rough: heavy capex, negative free cash flow, low-teens revenue growth, margin compression, more funding needed, and perceived OpenAI dependency. These optics create real fear, and fear creates selling pressure.

The pullback has brought forward P/E down to around 26x, which feels more reasonable than where it was trading a few months ago. I’m planning to add to my position during this weakness over time.

Here’s how I’m thinking about the risk/reward: This is somewhat of a CoreWeave-type bet for me. High growth potential if the AI wave plays out the way I expect, but they’ve gone all-in on the buildout. If AI demand disappoints or the ramp is slower than expected, this stock will have an extremely rough time. I’m comfortable with that risk in my portfolio, but it’s real.

What gives me conviction: As data centers come online, revenue should start catching up to capex, which would completely shift the narrative. On the OpenAI concentration concern, even if OpenAI struggles, I believe whoever wins the AI race will need all the compute they can get. OCI capacity gets used regardless of which customers scale fastest. Finally, Oracle sits on massive enterprise data relationships that create natural upsell opportunities for AI training and inference.

Join WhatTheChipHappened Community — 15% OFF Annual Use Code “CHIPS”

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclosures

This analysis is based on publicly available information from Oracle’s Q2 FY2026 earnings call, press release, and related SEC filings. The author and “What The Chip Happened” may hold positions in securities discussed. This is not investment advice. Do your own work.

Some investors might want a bit more data, and the portion below is an optional deep-dive for readers who want more detail. The main report stands alone without this. As I write these reports, certain things might just be too much, and I decide to cut off. Instead, I’ll add them here so the added research doesn’t go to waste.

A. Segment Deep Dive

Cloud Infrastructure ($4.1B, +66% YoY)

The star of the show, and it’s not close. OCI grew faster than the prior quarter despite an already massive base, driven by AI training and inference demand.

Key drivers:

GPU revenue up 177% YoY—the fastest-growing line item

Delivered 50% more GPU capacity than Q1

96,000+ NVIDIA GB200 GPUs at Abilene Supercluster on track

AMD MI355 deliveries began this quarter

Mega-customer traction:

Meta and NVIDIA contracts drove the $68B RPO addition

Uber surpassed 3 million cores (”highest traffic ever this Halloween”)

Temu scaled to ~1 million cores for Black Friday/Cyber Monday

Management commentary reveals strategic ambition beyond GPU rental:

“Our diversity of capabilities within infrastructure differentiates us from AI infrastructure neoclouds. Our unique combination of infrastructure and applications differentiates us from other hyperscalers.”

Dedicated Regions & Alloy (+69%):

39 live regions, 25 more planned

New launches: ITHCA Group (Oman), NTT Data, SoftBank

Dedicated Region 25: full OCI capability in 3-rack footprint

Multicloud Database (consumption +817%):

45 regions live across AWS, Azure, GCP; 27 more planned

New Universal Credits program enables single commitment across clouds

Channel reseller program launched

“Billions in identified pipeline”

Assessment: The 66% growth at this scale is remarkable, but the real story is diversification. Oracle is no longer just GPU rental for AI labs—it’s becoming infrastructure for hyperscalers (Meta), AI companies (NVIDIA, xAI, OpenAI), and enterprises running databases across multiple clouds.

Cloud Applications ($3.9B, +11% YoY)

The “boring” business that’s quietly accelerating while every SaaS peer decelerates.

Back-office strength:

Strategic back-office apps: $2.4B (+16%)

Fusion ERP +17%, SCM +18%, HCM +14%

Industry vertical momentum:

Combined industry clouds +21%

Healthcare: 274 clinical AI agent customers live in production

AI ambulatory EHR received U.S. regulatory approval

Q3 expectation: both bookings and revenue to “accelerate materially”

Leading indicator:

Deferred revenue +14% vs. in-quarter revenue +11%

330 cloud app go-lives in quarter (multiple per day)

Mike Sicilia explained the differentiation:

“We are the only applications company in the world that’s selling complete application suites... All of our competitors are largely in the best-of-breed business because they’re not in the applications business in totality. They’re not in the back-office business. They’re not in the industry business and they’re not in everything in between.”

The “1 Oracle” sales reorg—combining industry and Fusion sales teams—is driving larger, multi-component deals:

“This is something we’ve been talking about for many years, that is the synergies between our back-office applications and our industry applications. We’re seeing more and more deals where our industry apps are pulling Fusion, or the Fusion apps are pulling the industry apps. And as a result of seeing more and more deals, we’re also seeing larger deals with more components.”

Assessment: The 14% deferred revenue growth vs. 11% recognized is the number to watch. If Oracle can sustain applications acceleration while peers decelerate, it validates both the unified selling strategy and the AI feature investment (400+ features live in Fusion). The healthcare vertical is the proving ground for AI agents that implement in weeks without professional services.

B. Extended Quotes with Context

“Remaining performance obligations, or RPO, ended the quarter at $523.3 billion, up 433% from last year and up $68 billion since the end of August, driven by contracts signed with Meta, NVIDIA and others as we continue to diversify our customer backlog.” — Doug Kehring, EVP & Principal Financial Officer

Context: This extraordinary backlog growth ($68B added in one quarter) demonstrates unprecedented demand and provides multi-year revenue visibility. The 433% YoY growth is exceptional even for Oracle’s scale.

“Uber has now surpassed 3 million cores on OCI, powering their highest traffic ever this Halloween. Temu scaled to nearly 1 million cores for Black Friday and Cyber Monday.” — Clay Magouyrk, CEO (Infrastructure)

Context: Demonstrates OCI’s ability to handle massive scale and burst workloads for non-AI customers—Oracle isn’t just GPU rental.

“We also delivered 50% more GPU capacity this quarter than Q1... Our pace of capacity delivery continues to accelerate.” — Clay Magouyrk, CEO (Infrastructure)

Context: Directly addresses the core investor concern about converting demand to revenue. Faster delivery = faster revenue recognition = faster margin improvement.

“The good thing is that as I mentioned earlier, we don’t actually incur any expenses for the data centers until they’re actually built up and running...the period of time where we’re incurring expenses without that kind of revenue and the gross margin profile that we talked about is really on the order of a couple of months.” — Clay Magouyrk, CEO (Infrastructure)

Context: Explains the short lag between expense and revenue recognition for AI data centers, supporting the margin improvement thesis.

“As we go through this buildout phase, right now, we’re in a phase of very rapid buildout without the majority of the capacity online, obviously, the aggregate mix is going to be lower. But as we actually get the majority of this capacity online...the best way to improve margins quickly is to actually go out and deliver capacity faster.” — Clay Magouyrk, CEO (Infrastructure)

Context: Explains why margins are temporarily compressed (8% operating income growth vs. 13% revenue growth) and lays out the path to recovery: accelerate capacity delivery.

“Customers can actually bring their own chips. And in those models, Oracle obviously doesn’t have to incur any capital expenditures upfront for that model. Similarly, we have different models that we’re working on with different vendors where some vendors are actually very interested in the model where they rent their capacity rather than selling their capacity.” — Clay Magouyrk, CEO (Infrastructure)

Context: Key to the “substantially less than $100B” funding claim. These alternative financing models dramatically reduce Oracle’s capital requirements but were not quantified.

“In health care, in Q3, we expect both our bookings and our revenue to accelerate materially.” — Mike Sicilia, CEO

Context: Explicit forward commitment that will be scrutinized next quarter. Healthcare AI agents implementing in weeks (vs. months for traditional SaaS) could transform delivery economics.

“The cloud application deferred revenue is up 14%. That is higher than the cloud apps revenue growth of 11%, just to reinforce my earlier statements that we expect continued apps growth acceleration.” — Mike Sicilia, CEO

Context: Deferred revenue is a leading indicator. This growth spread provides concrete evidence for the applications acceleration thesis.

“The result is we now expect $4 billion of additional revenue in FY ‘27. Our full year FY ‘26 revenue expectation of $67 billion remains unchanged. However, given the added RPO this quarter that can be monetized quickly starting next year, we now expect fiscal 2026 CapEx will be about $15 billion higher than we forecasted after Q1.” — Doug Kehring, EVP & Principal Financial Officer

Context: Quantifies the FY27 revenue benefit from record Q2 bookings while signaling increased near-term CapEx investment. Shows management converting demand to revenue quickly.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Join WhatTheChipHappened Community — 15% OFF Annual Use Code “CHIPS”

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.