Margin Showdown: TI's Wafer Gamble, Intuitive's Robotic Surge, and Galaxy's $505M Crypto–AI Bet

Welcome, AI & Semiconductor Investors,

Texas Instruments just made that bold bet, strategically cutting wafer starts to guard its precious free cash flow, even as data center demand surges 50%+. Meanwhile, Intuitive’s da Vinci 5 robots are powering a 23% revenue jump, but can innovation offset looming tariff troubles? And in the crypto-meets-AI corner, Galaxy just clocked a massive $505 million profit while doubling down on an ambitious 800MW AI infrastructure build-out. — Let’s Chip In.

What The Chip Happened?

🔌 Texas Instruments: Navigating a Slow Recovery by Cutting Wafer Production to Safeguard Cash Flow

🤖 Intuitive: da Vinci 5 Drives Robust Q3 Results, Raises Outlook

🟢 “$505M and 800MW” — Galaxy’s Crypto–AI Flywheel Spins Faster

[Texas Instruments Q3 2025 Results: Playing it Smart in a Sluggish Market]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Texas Instruments (NASDAQ: TXN)

🔌 Texas Instruments: Navigating a Slow Recovery by Cutting Wafer Production to Safeguard Cash Flow

What The Chip:

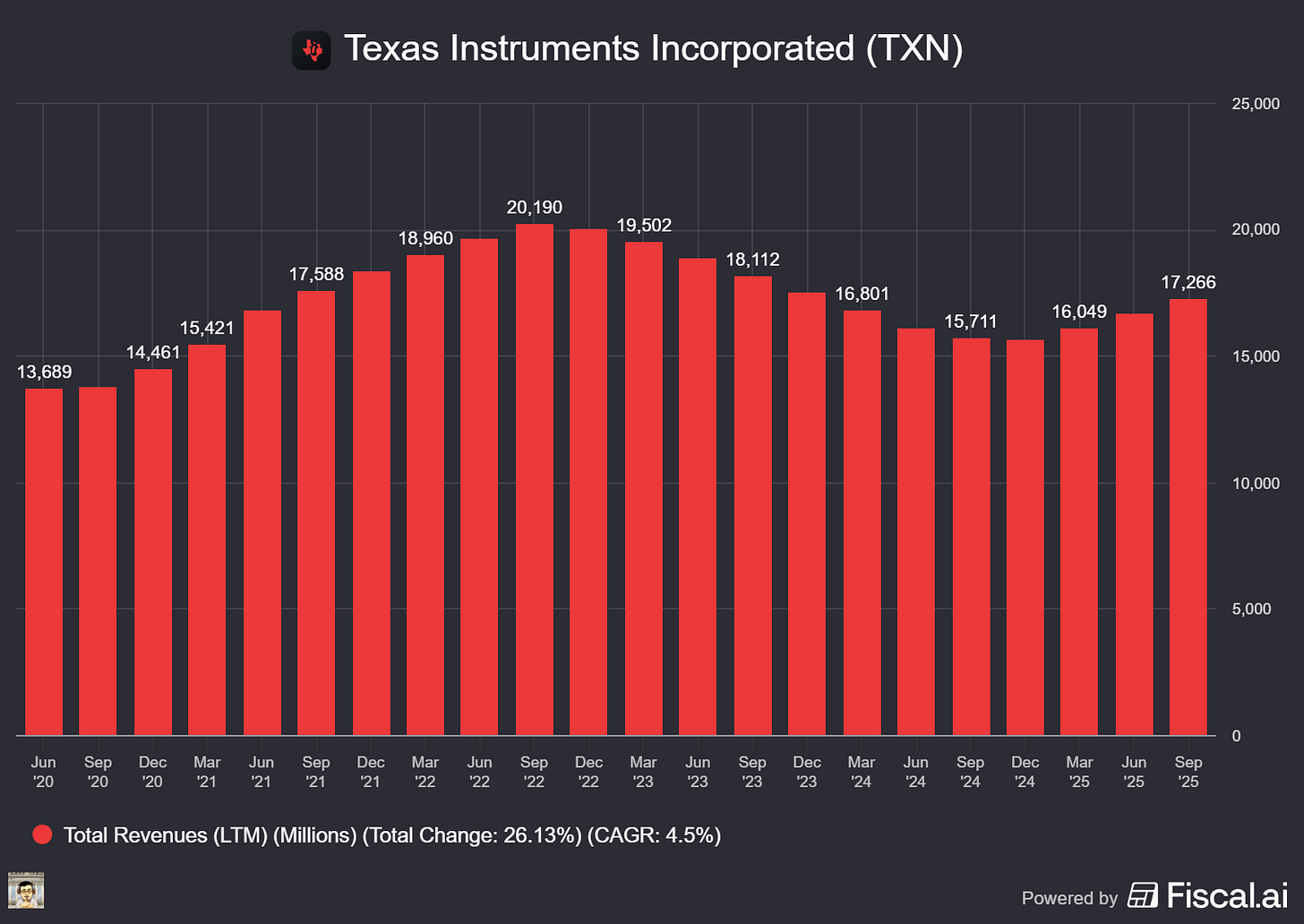

On October 21, 2025, TI reported Q3 revenue of $4.74 billion (+14% year-over-year) and earnings per share (EPS) of $1.48, including an unexpected $0.10 reduction due to restructuring charges and operational adjustments. Management guided Q4 revenue lower to $4.22–$4.58 billion, and EPS down to $1.13–$1.39, signaling plans to reduce wafer starts to control inventory amid a slower-than-expected market recovery.

Details:

📈 Growth Across Segments: CEO Haviv Ilan highlighted steady broad-based demand, noting revenue grew 7% sequentially and 14% year-over-year, driven primarily by the Analog (+16%), Embedded Processing (+9%), and Other (+11%) segments.

🧭 Market Breakdown:

Industrial: Up roughly 25% year-over-year but slowed to low single-digit growth sequentially, reflecting cautious customer investments.

Automotive: Rose high single digits year-over-year and around 10% sequentially, benefiting from content-driven secular growth.

Personal Electronics: Modest low single-digit year-over-year growth, improving sequentially in the high single digits.

Enterprise Systems: Strong performance, surging about 35% year-over-year and 20% sequentially due to robust data-center demand.

Communications Equipment: Jumped around 45% year-over-year and 10% sequentially, driven partly by data-center-related investments.

🧮 Margin Pressure and Inventory Management: Gross margins slightly compressed to 57% (down 50 basis points sequentially). CFO Rafael Lizardi explained the decline was due to lower utilization rates as TI intentionally trims wafer loadings. Depreciation, now running at $1.8–$2.0 billion annually and projected at $2.3–$2.7 billion next year (toward the lower end), is further pressuring margins. Management implied Q4 gross margins would likely trend towards the mid-50s percentage range.

🧱 Inventory Strategy: Inventory was essentially flat at $4.8 billion (215 days, down 16 days sequentially). Lizardi emphasized that TI aims to maintain or slightly reduce inventory levels in Q4, using moderated wafer production to prevent excess inventory build-up and protect free cash flow.

🔌 Accelerating Data Center Opportunity: TI disclosed plans to separately break out the Data Center segment in early 2026, noting it now represents about a $1.2 billion annual revenue run-rate and is growing rapidly at over 50% year-to-date. The growth spans multiple products including high-voltage DC power delivery, optical modules, and switching and interconnect solutions, driven by booming AI infrastructure investment.

🏭 Manufacturing Transitions and Restructuring: TI recorded a restructuring charge of $0.08 per share tied to shutting down its final 150mm (6-inch) fabs and consolidating certain R&D sites. Management reiterated their commitment to the significantly more cost-effective 300mm (12-inch) fabs, which allow more chips per wafer and superior economics long-term.

🌍 Macro Environment and Outlook: Ilan described the current semiconductor market recovery as moderate and slower-paced than typical cycles, pointing to customer hesitancy around CapEx spending due to lingering trade and tariff uncertainties. Customer inventories remain lean, pricing remains stable (declining at low single-digit percentages year-to-date), and TI maintains competitive lead times.

Why AI/Semiconductor Investors Should Care:

Investors should closely watch TI’s deliberate trade-off—accepting near-term margin pressure to strategically reduce wafer loadings and safeguard long-term free cash flow per share growth. More importantly, the growing significance of TI’s data-center business highlights a major AI-driven growth opportunity. If TI sustains its accelerated growth in data-center power and connectivity solutions while benefiting from improving scale efficiencies of its 300mm fabs, the company’s long-term earnings and free cash flow trajectory look compelling despite near-term margin volatility. However, uncertainty around industrial investment and geopolitical tariff headwinds could temper the near-term upside.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Intuitive Surgical (NASDAQ: ISRG)

🤖 Intuitive: da Vinci 5 Drives Robust Q3 Results, Raises Outlook 🚀

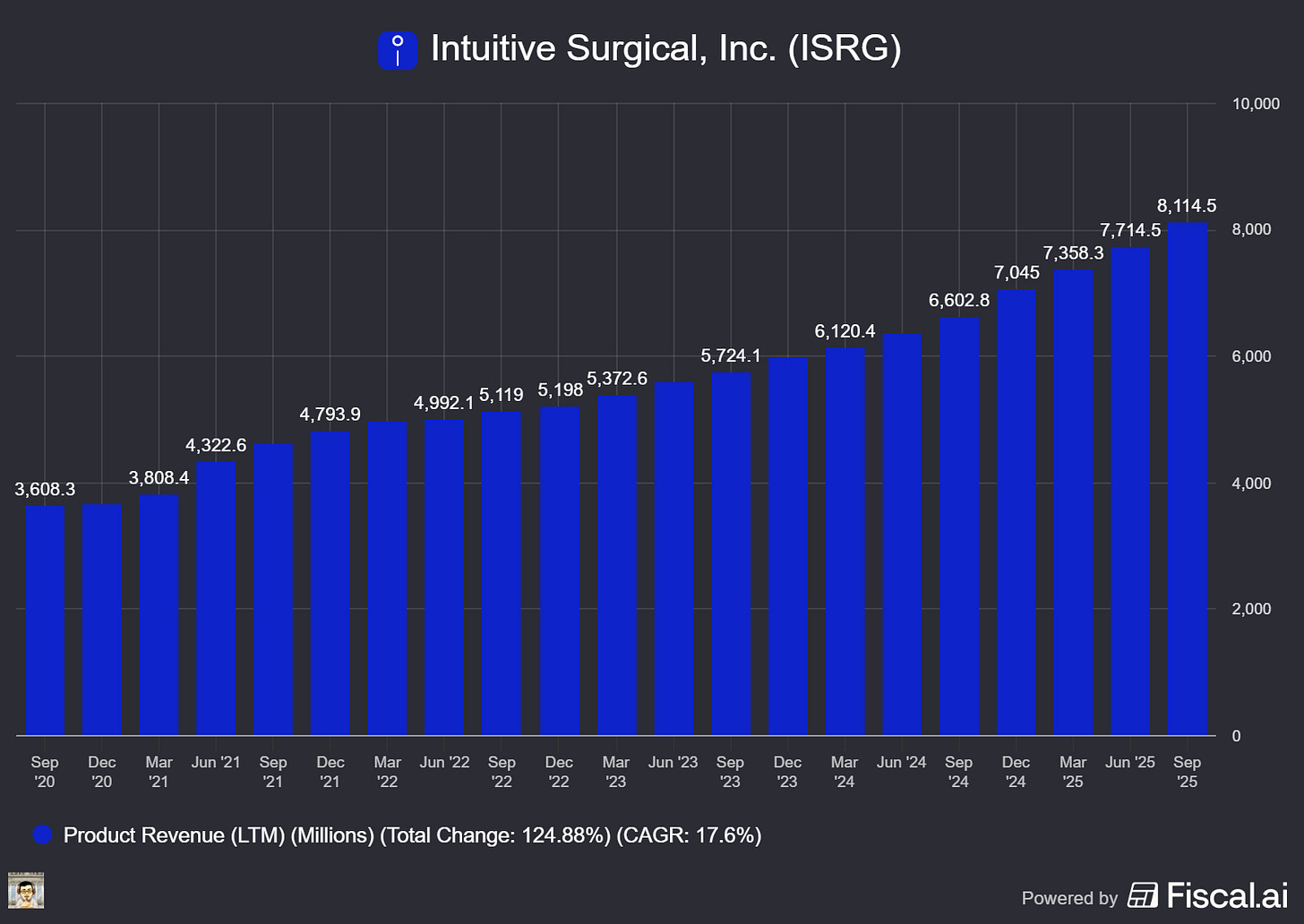

What The Chip: On October 21, 2025, Intuitive Surgical reported strong Q3 revenue of $2.51B (+23% YoY) driven by ~20% worldwide procedure growth and strong adoption of the new da Vinci 5 and Ion systems. Management increased full-year 2025 guidance, expecting da Vinci procedure growth of 17–17.5% and non-GAAP gross margin of 67–67.5%, despite a ~70 bps tariff impact.

Details:

📈 Procedure Momentum: Total procedures grew ~20%, led by da Vinci procedures (+19%) and Ion procedures (+52%, nearly 38,000 procedures). Utilization improved across platforms: multiport +4%, single-port (SP) +35%, and Ion +14%.

🧰 System Placements & Mix: Installed 427 da Vinci systems (+13% YoY), including 240 da Vinci 5 systems and 30 SP systems. Ion system placements were 50 units, slightly down from 58 units last year as customers prioritized utilization. Leasing accounted for 54% of placements.

💰 Financial Performance:

Revenue segments: Instruments & Accessories up 20% to $1.52B, Systems revenue up 33% to $590M, and Service revenue up 20% to $396M.

Non-GAAP net income rose to $867M ($2.40/share) from $669M ($1.84/share). GAAP net income reached $704M ($1.95/share).

$1.92B spent on repurchasing 4.0M shares; free cash flow was $736M. Cash and investments totaled $8.43B.

🌐 Global Trends: U.S. procedures rose 18%, driven by da Vinci (+16%) and Ion (+48%). International procedures grew 25%, benefiting from strong uptake in India, Korea, Taiwan, and Brazil, offset by budget constraints in Japan and the UK, and competitive pressures in China.

⚙️ Tech Enhancements:

da Vinci 5: New FDA-cleared features, including remote software updates, Force Gauge visual feedback, and integrated insufflation technology (used in ~90% of da Vinci 5 cases).

Ion: AI-driven navigation significantly improved diagnostic accuracy. A recent Swiss study showed Ion achieving an 84.6% diagnostic yield, dramatically outperforming traditional bronchoscopy (23.1%).

SP platform: Procedure growth surged 91%, driven by increased adoption in Korea and early U.S. utilization of new SP staplers.

📊 Updated 2025 Guidance:

Procedure growth: raised to 17–17.5%.

Non-GAAP gross margin: raised to 67–67.5%, inclusive of ~70 bps tariff impact.

Operating expenses: expected to grow 11–13%.

⚠️ Investor Considerations:

Margins: Pressured by tariffs and higher mix of lower-margin da Vinci 5 and Ion systems.

Bariatric Weakness: U.S. bariatric surgeries declined high-single digits due to ongoing GLP-1 drug competition.

China Competition: Continued price pressure amid slow tender processes.

Why AI/Semiconductor Investors Should Care: Intuitive Surgical continues to leverage robotics and AI-driven innovation, notably through its da Vinci 5 and Ion systems. These technological advancements demonstrate increased efficiencies, driving adoption and utilization. Despite margin pressures from tariffs and competitive international markets, Intuitive’s sustained growth in procedures and strategic portfolio diversification—including refurbished systems—indicates robust potential. The company’s ability to deliver consistent growth and upgrade its financial outlook underscores its strength and strategic position within the rapidly expanding surgical robotics market.

Galaxy Digital (NASDAQ: GLXY; TSX: GLXY)

🟢 “$505M and 800MW” — Galaxy’s Crypto–AI Flywheel Spins Faster

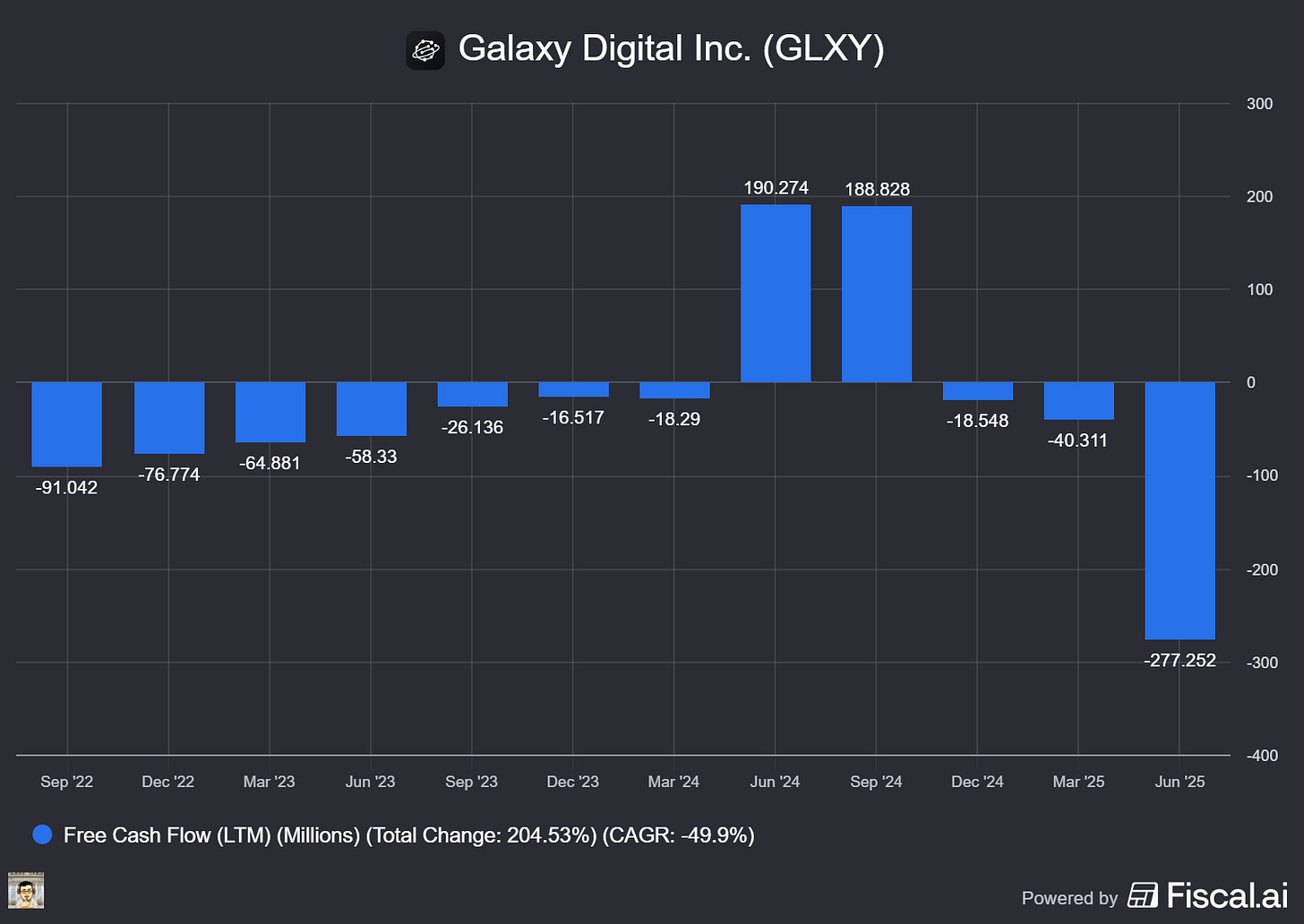

What The Chip: On October 21, 2025, Galaxy reported Q3 net income of $505M, diluted EPS $1.01 (adjusted $1.12), and adjusted EBITDA $629M. Management also firmed up the Helios AI/HPC buildout with CoreWeave—now contracted across the full 800MW—and secured financing to bring Phase I online in 1H26.

Details:

💰 Blowout quarter: Net income hit $505M (up 1,546% Q/Q), with adjusted EBITDA at $629M (up 198% Q/Q). Cash + stablecoins rose to $1.9B and total equity to $3.2B as of Sept 30.

🏗️ Helios = AI/HPC growth option (but 2026 revenue start):

• Phase I: 133MW critical IT load, delivery 1H26 (lease with CoreWeave).

• Phase II: 260MW, 2027 delivery (lease executed).

• Phase III: 133MW, 2028 start.

• Total committed critical IT load: 526MW (of 800MW gross power across Phases I–III).

• Financing: $1.4B project facility secured—fully funds the $1.7B Phase I build.

Galaxy expanded the campus to >1,500 acres with 2.7GW of additional potential power under ERCOT study. Management still guides to immaterial P&L from Data Centers until 1H26.

Novogratz on the ramp: “We start cash flowing… and 18 months after that, it’s hundreds of millions of dollars per quarter.”

🛠️ Product + capital: Galaxy launched GalaxyOne (Oct 6) to offer U.S. individuals high‑yield cash plus crypto and equities trading in one platform. On Oct 10, the company announced a $460M equity investment from a large asset manager, with $325M net proceeds earmarked for Helios and general purposes.

⚠️ Watch the risks:

• Concentration: CoreWeave is currently the sole contracted Helios tenant (800MW). Galaxy may diversify tenants on future power approvals.

• Cycle risk: Novogratz cautioned, “It feels like we’re in some stage of a bubble around data centers and AI… there will be an inevitable pullback… I don’t know if [it’s] in 3 months or 3 years.”

Why AI/Semiconductor Investors Should Care

Galaxy is morphing from a pure‑play crypto operator into a crypto–AI infrastructure hybrid: robust trading/asset‑management cash generation today, with a contracted, utility‑like lease ramp at Helios beginning 1H26. If CoreWeave’s AI/HPC demand persists, Helios could become a multi‑year free‑cash‑flow engine, diversifying away from crypto cyclicality. The bear case: data center/AI overbuild, tenant/credit and ERCOT/power risks, plus crypto drawdowns, could pressure cash generation and delay returns. Near‑term, track Helios construction milestones, power energization and cash‑flow ramp cadence, along with AUM/staking growth and loan‑book health—the levers that will determine how quickly Galaxy converts momentum into durable FCF.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] Texas Instruments Q3 2025 Results: Playing it Smart in a Sluggish Market

Event date: October 21, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

On October 21, Texas Instruments (Nasdaq: TXN)—or TI, as investors fondly call it—released third-quarter results that showcased solid growth despite a cautious semiconductor recovery. TI posted $4.74 billion in revenue, marking a healthy 14% increase year-over-year and 7% higher than the previous quarter. Net income came in at $1.36 billion, translating into earnings per share (EPS) of $1.48. However, there was a minor hiccup: EPS included an unexpected $0.10 reduction, primarily from restructuring charges linked to efficiency improvements and the planned closure of older fabs.

CEO Haviv Ilan kept things straightforward: “Revenue increased 7% sequentially and 14% from the same quarter a year ago, with growth across all end markets.” TI’s well-known cash-generation machine hummed along, delivering $6.9 billion in operating cash flow over the past year, and $2.4 billion in free cash flow, including incentives from Uncle Sam’s CHIPS Act. TI continued to reward shareholders generously, returning $6.6 billion over the last year through dividends and stock buybacks, marking its 22nd consecutive year of dividend hikes—talk about commitment.

Looking ahead to the holiday quarter, TI projected revenues between $4.22 billion and $4.58 billion, with EPS ranging from $1.13 to $1.39. The outlook incorporates changes from new U.S. tax legislation, setting an expected tax rate near 13%.

Now, let’s dig deeper into what’s driving TI’s steady performance, the bumps along the way, and how the semiconductor giant plans to navigate uncertain market waters.