The Great AI Power Play: Tech Giants Lock Down Energy, Chips, and China Access

Welcome, AI & Semiconductor Investors,

Google just dropped $4.75B on its own power company, Alibaba’s eyeing a half-billion-dollar AMD chip order, and Nvidia’s racing to ship 80,000 H200s to China before Lunar New Year. The AI infrastructure race is no longer just about silicon, it’s about securing the power to run it and the geopolitical access to sell it. — Let’s Chip In.

What The Chip Happened?

🔌 Google Buys the Power Company: $4.75B Intersect Deal

🇨🇳 AMD’s China Comeback: Alibaba Eyes 50K MI308 Chips

🔓 Nvidia’s H200 China Gambit: 80K Chips by February

Read time: 7 minutes

Join WhatTheChipHappened Community — 15% OFF Annual Use Code CHIPS

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

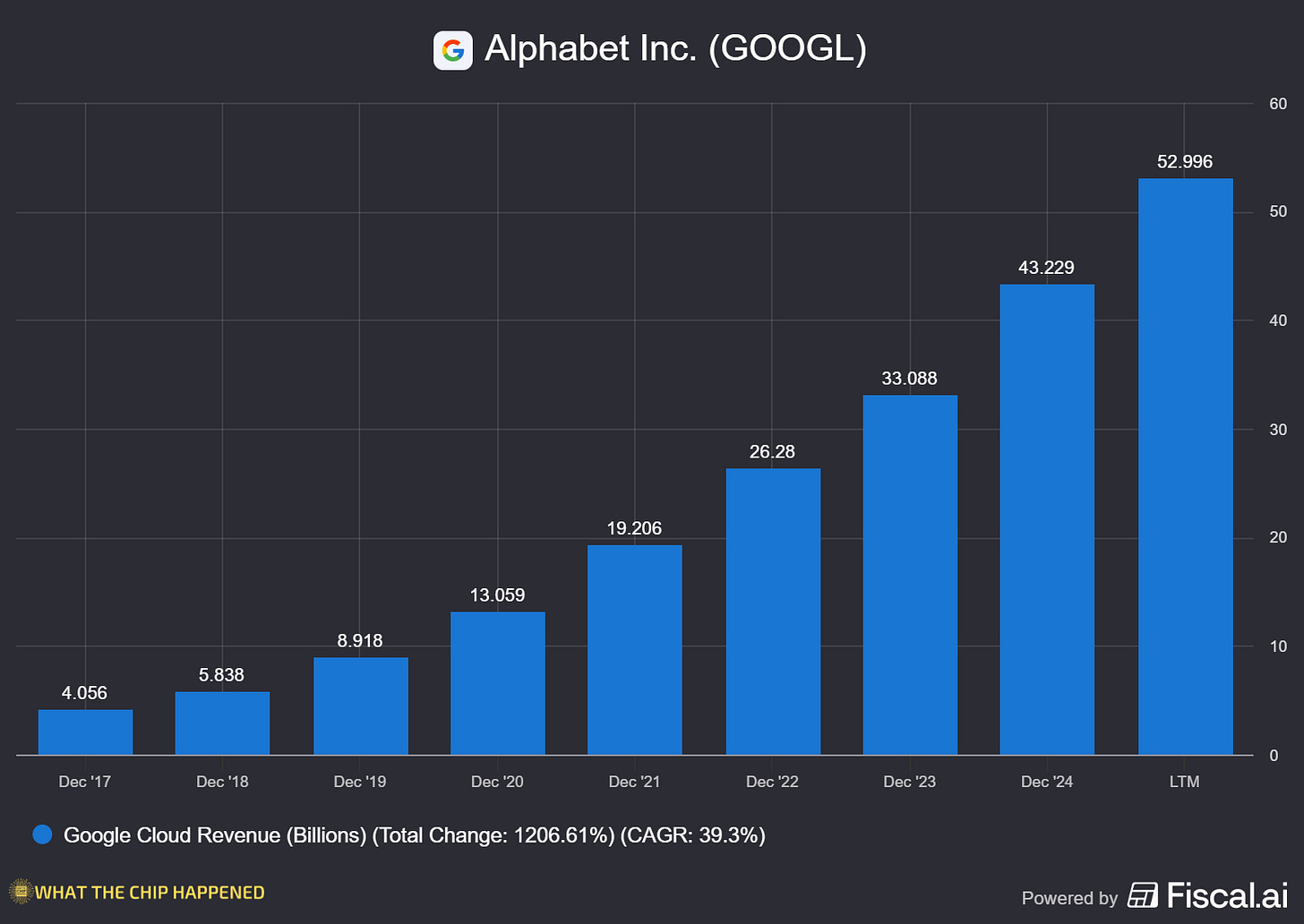

Alphabet Inc. (NASDAQ: GOOGL)

🔌 Google Drops $4.75B on Its Own Power Company to Fuel AI Dominance

What The Chip: On December 22, Alphabet announced it’s acquiring Intersect Power for $4.75 billion cash plus debt assumption, one of its largest acquisitions ever. This isn’t about search or cloud or quantum computers. It’s about raw electricity. Google is tired of waiting on utilities that can’t keep pace with AI’s hunger for power, so it bought multiple gigawatts of generation capacity and the team that knows how to build more. The deal transforms Google from a power customer into a power producer.

Details:

⚡ The Asset Haul: Intersect brings multiple gigawatts of energy projects in development or under construction, including Google’s existing partnership sites. By 2028, Intersect projects totaling 10.8 gigawatts are expected online, which is more than 20 times the Hoover Dam’s output. That’s serious infrastructure.

🏗️ Texas Anchors the Strategy: The crown jewel is Project Quantum in Haskell County, Texas, a 840 MW of solar PV and 1.3 GWh of battery storage, co-located with data centers. Google previously committed $40 billion to Texas through 2027, and this acquisition accelerates that buildout with dedicated power generation on-site.

🔋 Tesla Megapacks at Scale: Intersect secured 17.7 gigawatt-hours of Tesla Megapacks, making it one of the world’s largest buyers. Pair that with a multi-billion dollar First Solar partnership for American-made panels, and you’ve got a vertically integrated clean energy supply chain purpose-built for AI.

📦 What Stays, What Goes: The deal excludes Intersect’s existing Texas and California operating assets, which remain independent under TPG Rise Climate and other investors. Google gets the development pipeline and team, essentially buying future capacity, not legacy revenue streams.

💰 Google Already Had Skin in the Game: Alphabet held a minority stake after leading an $800M funding round in December 2024, targeting $20B in total investment by 2030. This acquisition fast-tracks that timeline and gives Google full control over execution.

🌍 Competitive Context: Amazon, Microsoft, and Meta have each announced multi-billion dollar data center investments requiring dedicated energy. Google’s moving first to own the entire stack, generation, storage, and data center infrastructure, while competitors still negotiate with utilities and independent power producers.

🔮 Beyond Solar and Batteries: Alphabet isn’t stopping at renewables. The company’s exploring advanced geothermal, long-duration energy storage, and gas with carbon capture. Translation: Google’s hedging its energy bets across every viable technology to ensure no bottleneck stalls AI scaling.

🚩 Integration Risk is Real: Google’s core competency is software and chips, not managing gigawatt-scale energy projects. Construction delays, permitting issues, and grid interconnection challenges could push timelines and balloon costs. Energy infrastructure is notoriously complex.

🎯 Timing and Regulatory Hurdles: Deal close is expected in H1 2026, subject to regulatory approval. Any delays extend Google’s dependence on third-party power while competitors potentially lock up their own capacity deals.

⚠️ The Bear Case is Simple: If energy buildout lags AI compute deployment, Google ends up with expensive power projects generating electricity for data centers that aren’t ready, or worse, stranded assets if AI demand doesn’t materialize as expected.

Why AI/Semiconductor Investors Should Care: Energy is the new chokepoint in AI. Google’s betting $4.75B that owning the power supply unlocks faster scaling than waiting on utilities. If Intersect delivers gigawatts on schedule, Google gains a structural advantage for training bigger models, deploying more inference capacity, and offering cloud customers guaranteed power availability. That’s a moat competitors can’t easily replicate. Watch for project timelines post-close and whether Microsoft or Amazon respond with their own energy M&A. The AI race just became an energy race, and Google fired the starting gun.

Join WhatTheChipHappened Community — 15% OFF Annual Use Code CHIPS

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

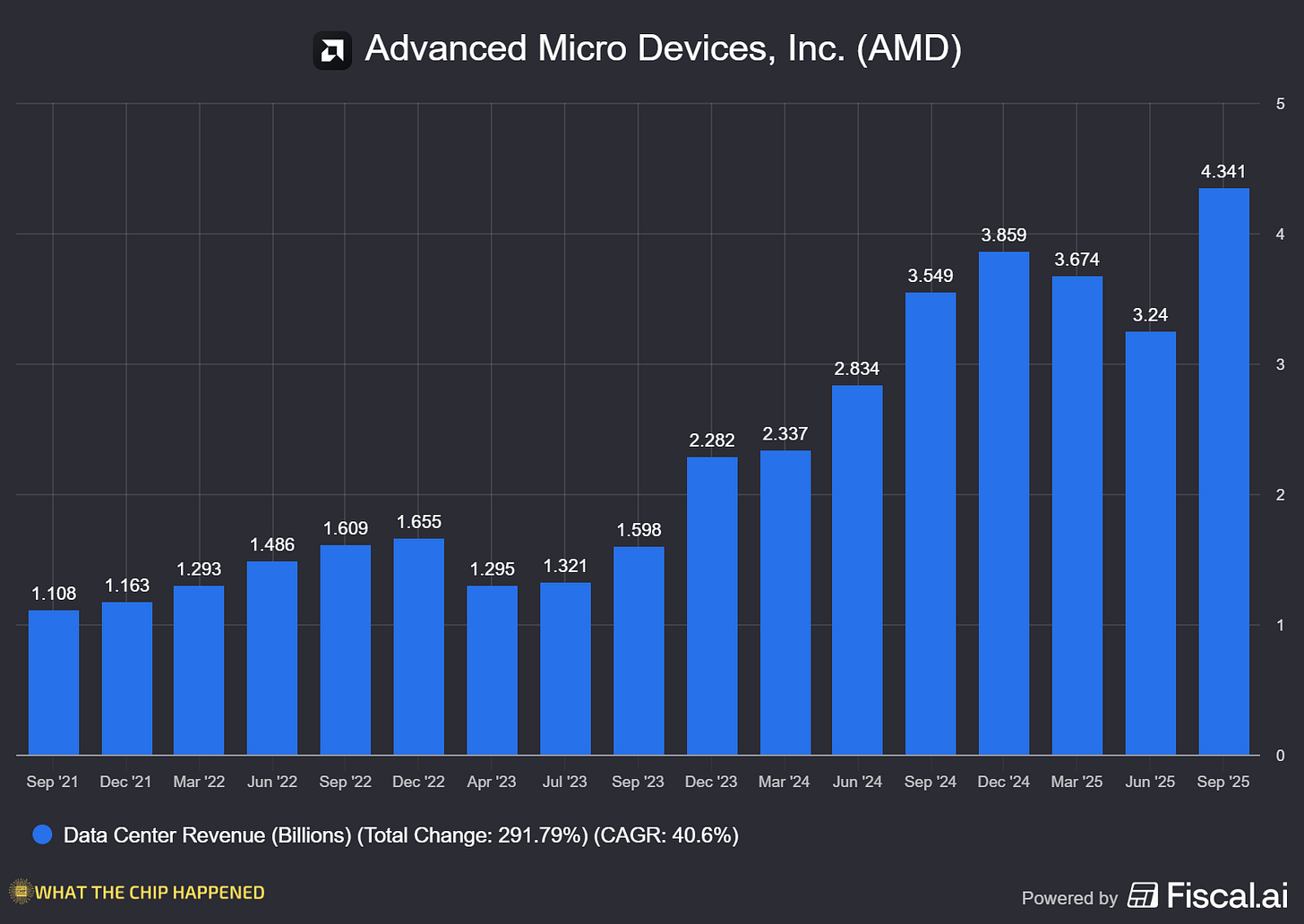

Advanced Micro Devices (NASDAQ: AMD)

🇨🇳 AMD’s Lisa Su Lands Alibaba’s 50K Chip Order After China Crackdown Thaw

What The Chip: AMD’s China-compliant MI308 accelerator is moving from vaporware to volume orders. Alibaba is reportedly considering purchasing 40,000 to 50,000 MI308 chips, a potential $500M+ deal that would mark one of AMD’s largest single Chinese orders since export controls began. The timing is perfect: President Trump just approved limited GPU sales with a 25% fee, and AMD CEO Lisa Su personally met with China’s Commerce Minister last week. If confirmed, this validates AMD’s strategy of building export-compliant chips while Nvidia dominated headlines.

Details:

💰 The Numbers Tell the Story: 40,000 to 50,000 MI308 accelerators would generate hundreds of millions in revenue, likely $500M+ depending on pricing. That’s meaningful scale for AMD’s data center segment, especially in a market where bulls questioned China relevance after export bans.

🛡️ MI308: The Compliance Play: The MI308 isn’t AMD’s flagship. It’s specifically designed to fall within U.S. export control performance limits, meaning it’s deliberately downgraded for the Chinese market. AMD’s playing within the rules, not pushing boundaries—a calculated move to avoid regulatory blowback.

📉 MI325: While the article reports that the chip will be the MI308, it is possible that the chip could be the MI325, as it's the equivalent of Nvidia’s H200, which just recently got approved by the current administration.

🤝 Lisa Su’s Diplomatic Tour: Su met with China’s Commerce Minister Wang Wentao last week to discuss operations and cooperation. No specifics were disclosed, but the timing, immediately before this order leaked, suggests the meeting wasn’t ceremonial. Su’s building relationships while competitors wait on policy clarity.

🚀 Guidance Upside Potential: AMD hasn’t included meaningful China revenue in recent forecasts, meaning a confirmed Alibaba deal would likely trigger upward revisions. That’s a catalyst the stock desperately needs after getting hammered on AI bubble fears.

🔵 MLex is the Sole Source: Currently, only MLex is reporting specific Alibaba-MI308 figures. Neither AMD nor Alibaba has commented publicly. Until confirmed, this remains a well-sourced rumor, not a guaranteed order. Investors should temper excitement until official announcement.

🎯 Alibaba’s AI Ambitions: Alibaba’s rapidly expanding cloud and large language model capabilities, which demand high-performance accelerators. The MI308 order aligns with their broader AI infrastructure buildout, signaling they’re prioritizing compute capacity for 2025-2026 deployments.

⚠️ Export Policy Remains Fluid: Trump’s approval for limited sales is reversible. Congressional scrutiny is intensifying, and any policy shift could freeze shipments mid-order. AMD’s exposure to Chinese policy whiplash is real.

Why AI/Semiconductor Investors Should Care: This order validates AMD’s China strategy at a moment when bears questioned its relevance. Even limited access to Chinese hyperscalers represents a multi-billion-dollar TAM, and AMD’s winning share despite being the underdog to Nvidia. If Alibaba confirms, expect analyst upgrades and momentum in AMD’s data center narrative. The stock needs positive catalysts after recent weakness, and a $500M order delivers exactly that. Watch for official confirmation, additional Chinese hyperscaler orders, and any MI308 follow-on capacity announcements.

Join WhatTheChipHappened Community — 15% OFF Annual Use Code CHIPS

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

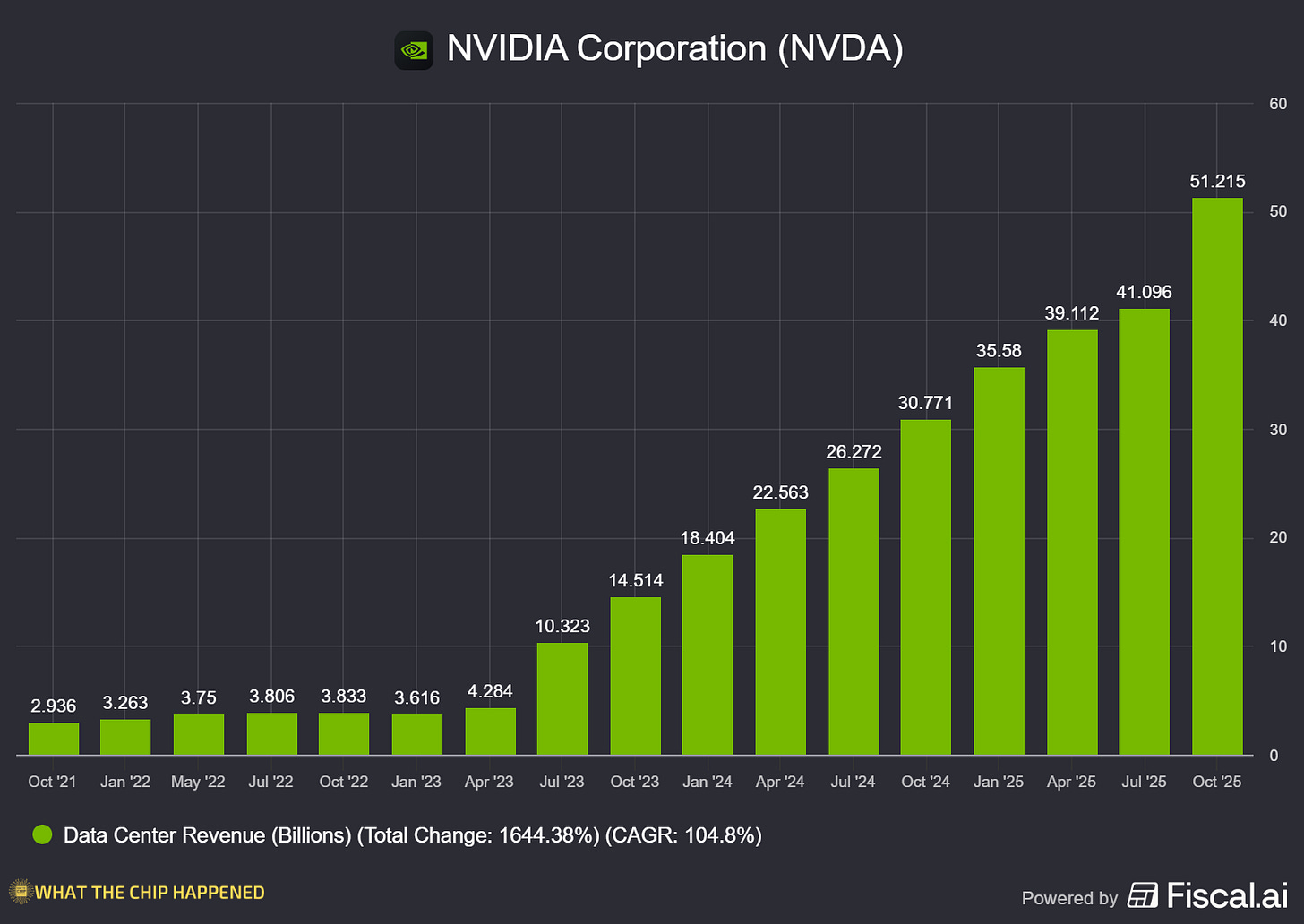

NVIDIA Corporation (NASDAQ: NVDA)

🔓 Nvidia Races to Ship 80,000 H200 Chips to China Before Lunar New Year

What The Chip: Nvidia’s targeting mid-February shipments of H200 chips to China, according to a report today by Reuters. The first deliveries of its second-most-powerful AI accelerators since Trump greenlit exports with a 25% fee. Initial shipments could total 40,000 to 80,000 H200 chips from existing inventory, with new production capacity opening Q2 2026. For Alibaba, ByteDance, and other Chinese AI giants, this is a game-changer: H200s are six times more powerful than the downgraded H20s they’ve been stuck with. But dual approval from Washington and Beijing is far from guaranteed.

Details:

📦 Initial Inventory Drop: Nvidia’s fulfilling first orders from existing stock, 5,000 to 10,000 chips, translating to 40,000 to 80,000 H200 chips. That’s immediate revenue recognition if shipments clear customs, no waiting on new production ramps.

🔮 Q2 2026 Capacity Expansion: Beyond the initial batch, Nvidia’s adding new H200 production capacity with orders opening second quarter 2026. That signals confidence in sustained Chinese demand despite political uncertainty, Nvidia’s betting this isn’t a one-time opening.

💰 25% Government Fee: The U.S. takes a quarter of every sale. That’s a significant margin hit, but access to China’s AI market justifies the toll. Nvidia’s effectively paying for permission to compete against AMD and domestic Chinese alternatives.

🏛️ Interagency Review in Progress: Commerce Department sent license applications to State, Energy, and Defense for review, standard 30-day process. If agencies disagree, Trump makes the final call. That’s a political wild card that could swing either direction based on headlines and lobbying.

⚡ H200 vs. H20 Performance Gap: Chinese customers have been limping along with H20s, deliberately crippled chips designed to meet export thresholds. H200s deliver six times the performance, fundamentally changing what AI models Chinese firms can train and deploy.

🇨🇳 Beijing’s Hesitation: Chinese officials held emergency meetings this month, debating whether to allow imports. One proposal requires bundling each H200 purchase with domestic chips at a set ratio, forcing customers to buy inferior local silicon alongside Nvidia’s premium hardware.

🚩 Domestic Chip Industry Pressure: China’s invested billions in homegrown AI accelerators, and allowing H200 imports risks undercutting that progress. Beijing’s caught between satisfying Alibaba and ByteDance’s immediate needs and protecting long-term strategic independence. No easy answers.

📈 Market Reaction: Nvidia jumped 3.93% Monday on export approval progress. Analysts maintain Strong Buy consensus (39 Buys, 1 Hold, 1 Sell) with an average $263.58 target—45.6% upside from current levels.

⚠️ Congressional Opposition Brewing: Critics argue large-scale H200 exports represent a strategic error, handing China capabilities that narrow the AI gap. The proposed SAFE Chips Act could reverse course, and vocal opposition from defense hawks could pressure Trump to tighten restrictions.

Why AI/Semiconductor Investors Should Care: Reopening China, even partially, expands Nvidia’s addressable market by billions and validates the bull thesis that U.S. chips remain essential despite Chinese domestic efforts. If shipments proceed, Nvidia locks in revenue from customers who’ve been sidelined for quarters, and competitors face an even steeper uphill battle. But dual approval from Washington and Beijing is uncertain, and Congressional scrutiny is intensifying. This is high-reward, high-risk, watch for license approvals, Beijing’s bundling requirements, and any SAFE Chips Act momentum. If 80,000 H200s ship by February, Nvidia’s China comeback is real. If approvals stall, it’s back to export control limbo.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Join WhatTheChipHappened Community — 15% OFF Annual Use Code CHIPS

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.