Waymo Eyes $100B, Tesla Goes Driverless, OpenAI Draws More, and Palantir Builds a 2,000-Person AI Army

Welcome, AI & Semiconductor Investors,

Palantir just weaponized Accenture’s enterprise rolodex with a 2,000-person deployment force, OpenAI claimed the image generation crown with GPT Image 1.5 while quadrupling speed, and the robotaxi wars exploded as Waymo chases a $100B valuation while Tesla removes safety drivers in Austin. — Let’s Chip In.

What The Chip Happened?

🤝 Palantir Weaponizes Accenture’s Rolodex With 2,000-Person AI Blitz

🎨 OpenAI Drops GPT Image 1.5: 4x Faster and #1 Ranked

🚗 Waymo Eyes $100B While Tesla Goes Full Driverless in Texas

Read time: 7 minutes

Join WhatTheChipHappened Community — 15% OFF Annual Use Code CHIPS

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Palantir Technologies (NASDAQ: PLTR)

🤝 Palantir and Accenture Launch 2,000-Person AI Army for Enterprise Domination

What The Chip: Palantir just solved its biggest growth problem, limited implementation capacity and painfully long enterprise sales cycles. The company announced a massively expanded partnership with Accenture, creating the dedicated “Accenture Palantir Business Group” staffed with over 2,000 Palantir-trained professionals plus embedded Forward Deployed Engineers. Accenture is now Palantir’s “preferred global partner” for enterprise transformation, giving PLTR instant access to Accenture’s massive client base across healthcare, telecom, manufacturing, consumer goods, and financial services.

Details:

🚀 Partnership Structure: The new “Accenture Palantir Business Group” operates as a dedicated unit with joint FDEs working side-by-side with enterprise clients. This isn’t a loose referral arrangement—it’s a fully integrated deployment engine that Palantir could never build alone.

💪 Scale of Firepower: Over 2,000 Accenture professionals are now Palantir-skilled, creating a scalable implementation force that addresses PLTR’s historical constraint. These aren’t just salespeople, they’re technical resources who can actually deploy Foundry and AIP at enterprise scale.

🎯 Strategic Designation: Accenture named as Palantir’s “preferred global partner” for enterprise transformation. In Palantir’s typically exclusive ecosystem, this designation signals serious strategic alignment and likely preferential economics.

📈 Early Traction: The partnership is already showing momentum in government, energy, and oil & gas sectors. Now expanding deliberately into healthcare, telecommunications, manufacturing, consumer goods, and financial services, all massive TAMs.

💡 Value Proposition: Tackles the enterprise pain point of “siloed data” by combining Accenture’s implementation muscle with Palantir’s integration platform. The pitch is compelling: unified AI-powered decision making across previously disconnected systems.

⚡ Speed to Value: Partnership explicitly designed to help enterprises “transform at speed and scale”, addressing feedback that Palantir implementations take too long. With 2,000+ trained implementers, time-to-value should compress meaningfully.

🛡️ Platform Lock-In: Deployments leverage Palantir Foundry and AIP as the core platform. Once enterprises standardize on these for AI infrastructure management, switching costs become prohibitive, exactly the moat Palantir wants.

🔮 Go-to-Market Acceleration: Accenture already has relationships with most Fortune 500 companies. Instead of Palantir cold-calling for 18 months, Accenture can embed PLTR into existing transformation contracts. Sales cycle compression is the real prize here.

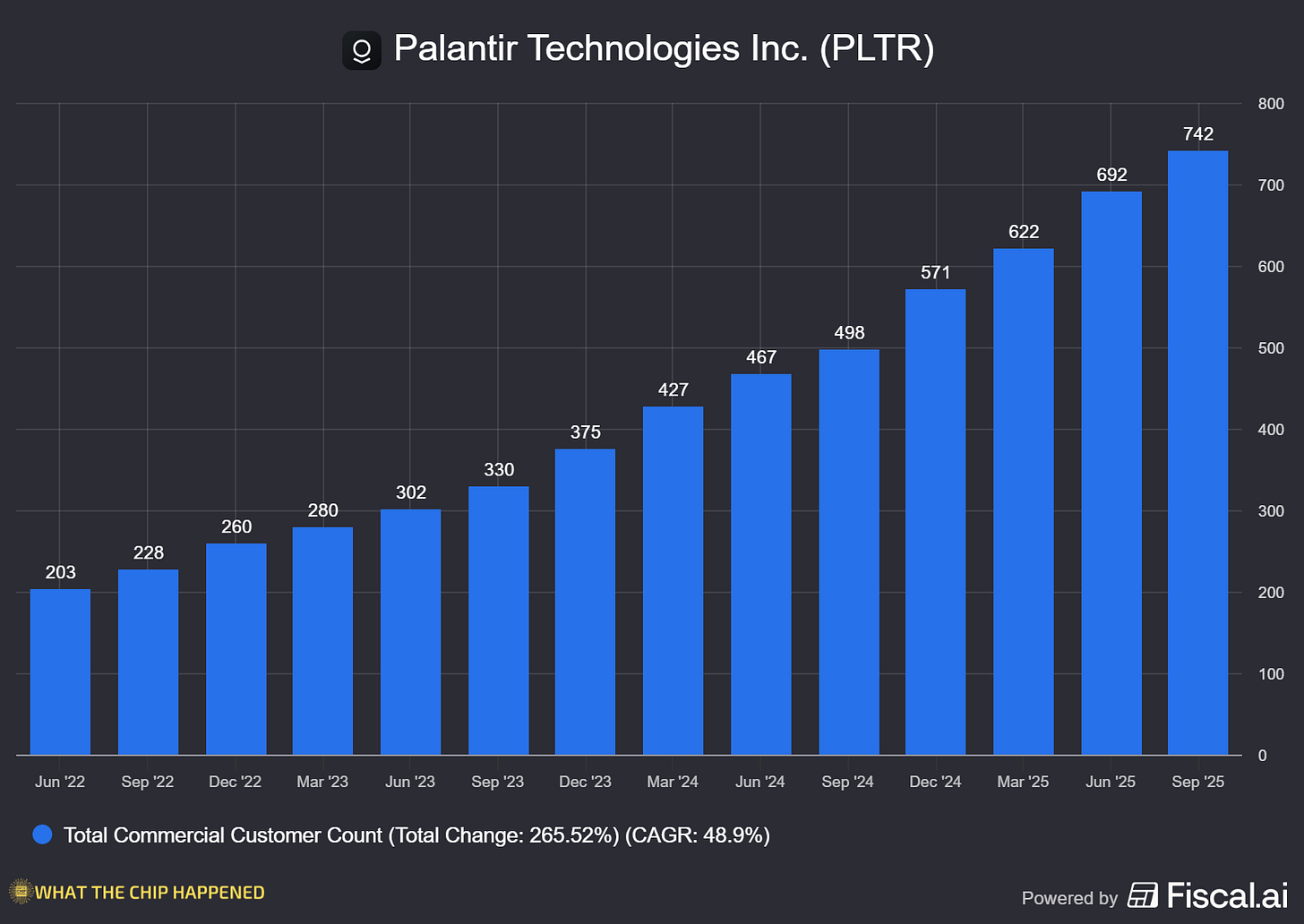

Why AI/Semiconductor Investors Should Care: This partnership could be the critical point for Palantir’s commercial business. The company has demonstrated product-market fit but struggled with implementation scalability, 2,000 trained Accenture professionals solves that overnight. Watch commercial customer count and average contract values over the next 2-3 quarters. If this partnership actually delivers bookings acceleration, PLTR’s commercial growth rate (already strong) could surprise to the upside. The bear case: revenue-sharing with Accenture will pressure margins, and Palantir’s premium positioning risks commoditization when bundled into broader consulting deals. But if Karp is willing to sacrifice some margin for distribution scale, that’s a sign of confidence in the TAM.

OpenAI

🎨 OpenAI Drops GPT Image 1.5: 4x Faster, #1 Ranked, Game Over for Banana?

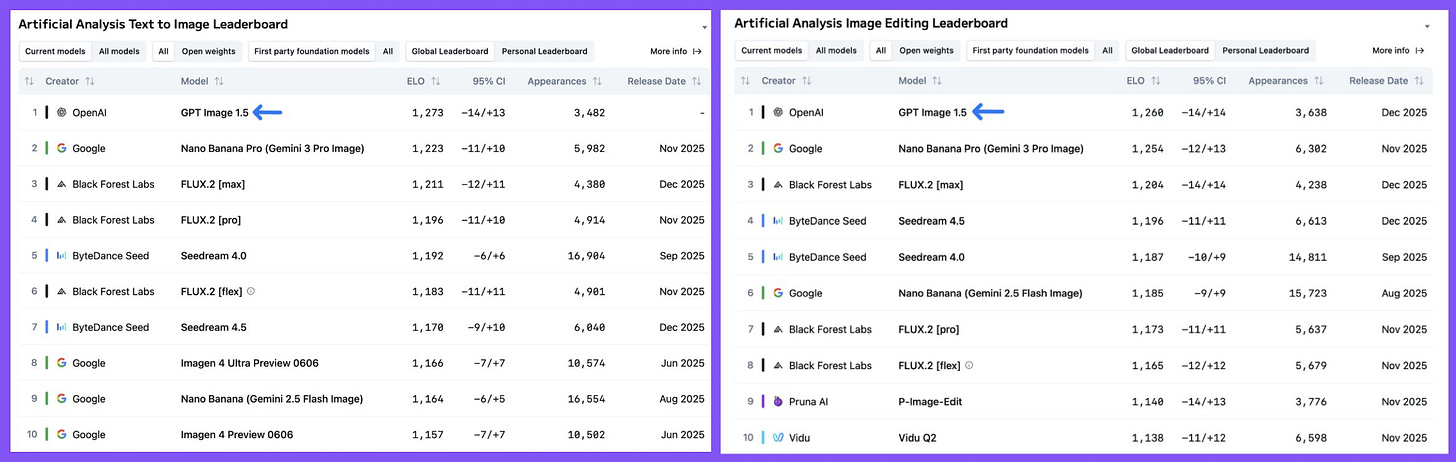

What The Chip: OpenAI just dropped GPT Image 1.5, and it’s not subtle, 4x faster image generation while claiming the #1 spot in both text-to-image AND image editing on Artificial Analysis’s Image Arena. The model excels at surgical photo editing, changing only what you request while preserving lighting, composition, and fine details. Available now to all ChatGPT users and via API, this positions ChatGPT as a “creative studio in your pocket” and puts serious pressure on Google, Midjourney, Adobe Firefly, and Stability AI.

Details:

⚡ Speed Blitz: Image generation is now up to 4x faster than previous ChatGPT capabilities. In a market where latency kills user experience, this matters, especially for iterative creative workflows where users generate dozens of variations.

🏆 Benchmark Dominance: GPT Image 1.5 ranks #1 in BOTH Text-to-Image AND Image Editing categories on Artificial Analysis Image Arena, surpassing Nano Banana Pro and other leading models. OpenAI isn’t just competitive, they’re setting the benchmark.

💼 Enterprise Use Cases: Practical applications unlock immediately: clothing/hairstyle try-ons for e-commerce, stylistic filters for marketing, conceptual transformations for product design. These aren’t hobbyist features, they’re monetizable B2B capabilities.

🔌 API Availability: Developers can access “GPT Image 1.5” via API immediately. This enables third-party applications to integrate best-in-class image generation without building competing infrastructure.

💰 Aggressive Pricing: Token-based pricing runs approximately $133 per 1,000 images at high quality (1MP), down to $9 per 1,000 images at low quality. That high-quality price point could pressure margins if usage scales, but it’s competitive with Adobe and significantly cheaper than human designers.

🚀 Competitive Kill Shot: This directly targets Midjourney (best image quality), Adobe Firefly (professional editing), and Stability AI (open-source alternative). OpenAI is bundling best-in-class generation AND editing into the world’s most-used AI interface.

Why AI/Semiconductor Investors Should Care: OpenAI is methodically closing the moat around creative AI tools. Achieving #1 rankings across categories while embedded in ChatGPT creates a distribution advantage competitors can’t match. Watch for enterprise adoption metrics and API usage growth. If this accelerates OpenAI’s path to profitability ahead of rumored 2025 funding rounds, it strengthens the bull case for the entire AI application layer. The risk: aggressive pricing ($133/1k images) and delayed Business/Enterprise rollout hint at capacity constraints or margin pressure.

Join WhatTheChipHappened Community — 15% OFF Annual Use Code CHIPS

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Alphabet (NASDAQ: GOOGL) / Tesla (NASDAQ: TSLA)

🚗 Waymo Eyes $100B Valuation as Tesla Goes Fully Driverless in Texas

What The Chip: The autonomous vehicle wars just went from simmer to boil. Waymo is in discussions to raise more than $15 billion at a valuation approaching $100 billion, more than double its $45 billion October 2024 valuation. Simultaneously, Tesla is testing driverless vehicles in Austin without safety drivers, six months after launching limited Robotaxi service with humans on board. These twin developments mark the commercialization inflection point for self-driving technology.

Details:

💰 Waymo Valuation Explosion: From $45B in October 2024 to potentially $100-110B in early 2026. That’s $55B+ in value creation in roughly one year, driven by operational scale, safety data, and commercial traction. For GOOGL shareholders, this could be a massive value unlock via spinoff or IPO.

🚀 Waymo Ride Volume Surge: Now delivering 450,000 weekly driverless rides across Austin, Phoenix, San Francisco, Los Angeles, and Atlanta, an 80% increase from 250,000 rides six months ago. This isn’t pilot program scale anymore; it’s a real transportation network.

🛡️ Safety Moat: Waymo’s robotaxis were involved in 90% fewer serious injury or worse crashes compared to human drivers. That safety record is the regulatory and insurance moat that justifies a $100B valuation. Data wins policy arguments.

🌍 Aggressive Expansion: Waymo is launching in St. Louis, Pittsburgh, Baltimore, Philadelphia, New Orleans, Tampa, and Minneapolis. Plus international expansion to London (rides starting 2026) and Tokyo (vehicle training underway). This is a global scaling play.

📏 Operational Scale: 127 million miles driven without a human driver through September, including 56.5M in Phoenix and 38.8M in San Francisco. Fleet size exceeds 2,500 vehicles. Waymo has more autonomous miles than any competitor, and it’s not close.

⚡ Tesla Goes Driverless: A Tesla vehicle was spotted driving Austin public roads without anyone in the driver’s seat or safety monitor. Musk confirmed testing began “within the next three weeks” after his earlier announcement. This is the make-or-break moment for Tesla’s camera-only approach.

💵 Cost Advantage: Morgan Stanley estimates Tesla’s robotaxi cost at $0.81 per mile versus Waymo’s $1.36-$1.43 per mile. If Tesla can validate safety at that cost structure, they win on unit economics. Morgan Stanley expects Waymo to narrow the gap once next-gen hardware scales in 2027.

🚩 Tesla Safety Questions: Seven collisions reported in Tesla’s Austin fleet as of mid-October. NHTSA launched an investigation into 2.88M Tesla vehicles in October for traffic violations and dangerous FSD maneuvers. Safety validation is the bottleneck.

⚠️ Regulatory Window Closing: Texas requirements change in May 2026 with Senate Bill 2807, autonomous-vehicle operators will require DMV authorization for commercial use. Tesla has a six-month window to prove driverless capability before regulations tighten.

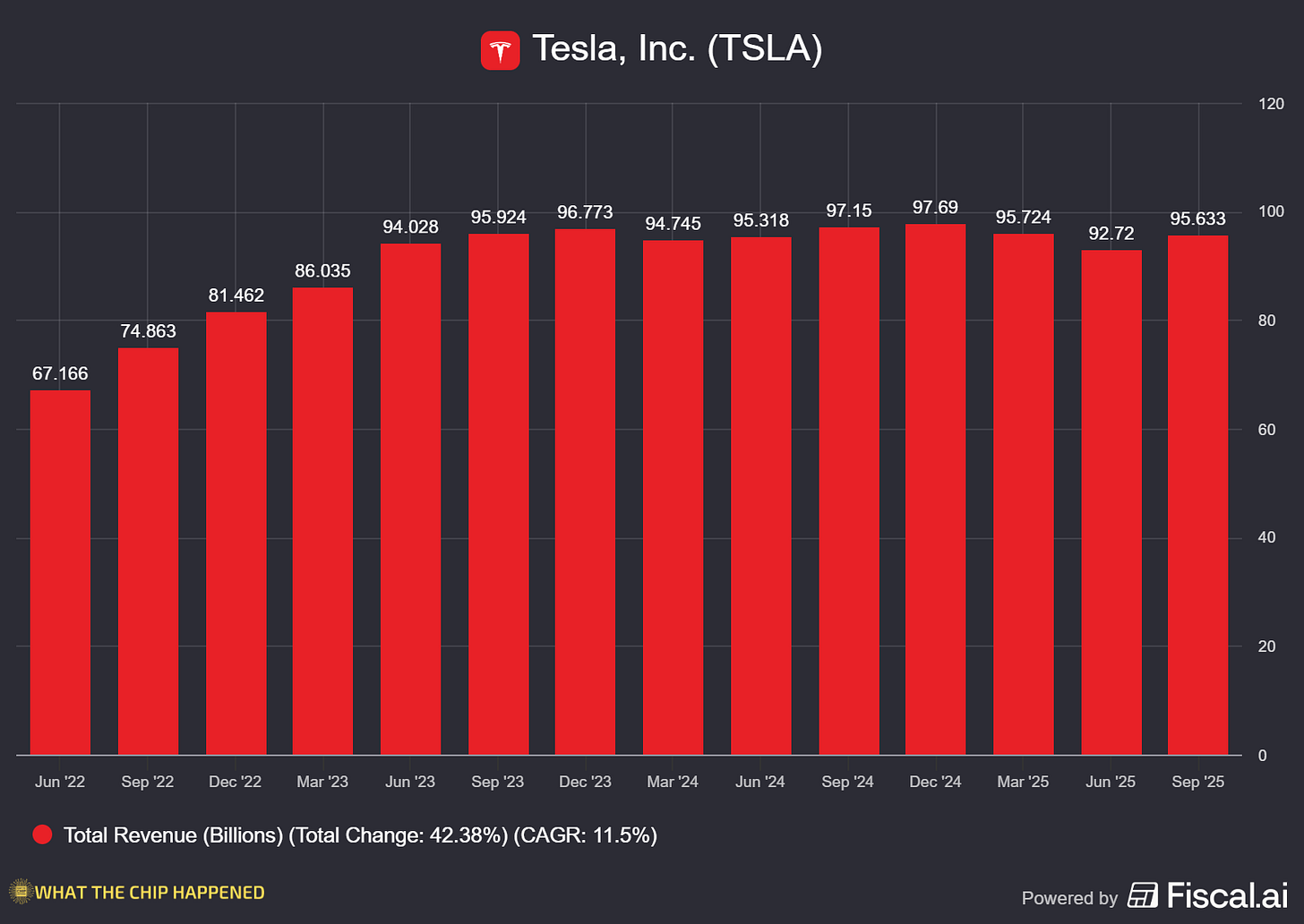

Why AI/Semiconductor Investors Should Care: Waymo’s $100B valuation would unlock massive value for GOOGL shareholders, potentially $70B+ in equity value if marked-to-market. An IPO or spinoff in 2026 could be one of the decade’s largest tech offerings. For TSLA, the stakes are existential: Musk has bet the company’s narrative on FSD and robotaxis delivering a $5 trillion valuation. The next six months determine if that’s vision or vaporware. Watch Waymo’s funding close (expected early 2026), Tesla’s timeline to paying passengers in truly driverless vehicles, and NHTSA investigation outcomes.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Join WhatTheChipHappened Community — 15% OFF Annual Use Code CHIPS

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.